Nobody needs to record for chapter, however in case you are heading in that course, delaying the inevitable might most effective make issues worse.

Bankruptcies are nonetheless considerably beneath pre-pandemic ranges, however have long past up relative to ultimate 12 months. Non-public bankruptcies have been up 16% in October from a 12 months in the past, as extra American citizens are in the hunt for debt reduction. However the ones suffering to stick financially afloat will have to believe the choice quicker slightly than later, advise professionals who learn about when and why other folks record.

“When a client feels monetary force, the very last thing on their thoughts is looking for chapter coverage,” mentioned Michael Hunter, vp, industry construction, at Epiq Aacer, a supplier of chapter knowledge and spouse to the American Chapter Institute, or ABI. Most of the people do not record till 18 to 24 months after they have incurred monetary hardship, Hunter mentioned.

Researchers, over a long time of interviewing hundreds of people that’ve declared private chapter, have discovered that about two-thirds of person filers combat with paying their money owed for as much as 5 years ahead of in the hunt for lend a hand.

“The typical reaction is individuals are suffering with their debt for greater than two years” ahead of in the hunt for a criminal treatment, Robert Lawless, a professor on the College of Illinois Faculty of Legislation, informed CBS MoneyWatch.

“Other folks misunderstand chapter and wait too lengthy to look a chapter legal professional. Most of the people would get advantages by means of going previous,” mentioned Lawless, a co-principal investigator within the Shopper Chapter Challenge, introduced in 1981 by means of a gaggle of lecturers together with Senator Elizabeth Warren, D-Mass., a regulation faculty professor on the time.

When to record for chapter

As a result of the stigma and disgrace that American citizens connect to chapter, other folks flip to it as a final hotel — oftentimes after they’ve plowed via retirement price range and different belongings that will be had been protected from collectors by means of submitting for debt reduction.

“If you’re raiding pension or different retirement belongings, that may be a crimson flag,” mentioned Lawless, noting the ones price range are secure from collectors in chapter. Borrowing cash to hide present bills is every other warning call, he presented.

“It is sensible to record if a creditor goes with the intention to remove one thing you wish to have,” mentioned Pamela Foohey, a professor of regulation on the College of Georgia Faculty of Legislation in Athens. “If an individual is coping with a salary garnishment this is harming their lives, or if a lender is threatening to repossess your automotive. If there is no different technique to get a automotive that may suit your finances, submitting can be a technique to stay your automotive, or stay your home.”

Another way the extensive resolution is to first deal with how they may resolve the reason for their monetary misery ahead of submitting for chapter. “It does not lend a hand to discover a better-paying process if after chapter extra goes out than coming in,” mentioned Lawless.

“Should you misplaced your process, record after you discovered a brand new process; you probably have a well being disaster, you record after you will have gotten higher to discharge the entire scientific debt that you have racked up,” mentioned Foohey.

If anyone undergoes a metamorphosis of their circle of relatives state of affairs, whether or not it is a divorce or the delivery of twins, she advises that they first determine how they are going to set up going ahead on the cheap after the debt is discharged.

“Chapter does something, it removes debt. It does not in finding you a role, it does not put cash for your pocket,” mentioned Lawless.

Additionally, legally talking, as soon as debt is discharged or a monetary reimbursement plan is licensed by means of a pass judgement on, it’ll be every other 5 to eight years ahead of one can record once more.

Bankruptcy 7 as opposed to Bankruptcy 13

It prices about $1,500 to record Bankruptcy 7, and maximum lawyers require that their charges be paid in advance. Bankruptcy 7 is a liquidation chapter, the place one’s nonexempt assets and belongings — possessions no longer secure by means of chapter — are grew to become over to a trustee, and debt is discharged in 3 to six months. Consistent with Lawless, 95% of Bankruptcy 7 would not have any belongings to show over.

With a Bankruptcy 13, bills will also be unfold out, then again the whole price is much more.

Having to rent and pay an lawyer a number of hundreds bucks could also be a frightening prospect for the ones in monetary turmoil, however Lawless mentioned a legal professional is a more sensible choice than submitting for chapter your self or taking a look to shopper credit score counseling — a carrier this is in most cases for-profit and has a protracted historical past of issues.

“In Bankruptcy 13, lawyers can permit for not anything in advance, put all their charges within the reimbursement plan, and on moderate rate $4,500,” Foohey mentioned.

Consistent with Foohey, most effective a couple of 3rd of those that record Bankruptcy 13 make it to the top and feature their money owed discharged. “No longer everybody needs the release, however to reset their dating with their loan holder,” she mentioned.

Epiq AACER

A Bankruptcy 13 comes to committing to a 3- to 5-year reimbursement plan. Then again, many filers that input the agreements do not entire them, Lawless relayed. “Householders will record 13 so they do not lose their house. It is a number of the gear used to get stuck up on loan bills,” he mentioned.

Legal professionals rate some distance much less for Bankruptcy 7, as it is a less-complicated procedure than a Bankruptcy 13. The latter is used for, however a nasty thought, to pay for one’s chapter.

“In 7, you must pay to your chapter in advance. In Bankruptcy 13 you pay your lawyer in that 3- to 5-year plan,” mentioned Lawless. “In case you are the use of 13 to pay your lawyer feels this is typically the mistaken selection.”

In Lawless’ view, “the No. 1 factor Congress will have to do is make it imaginable to pay your Bankruptcy 7 lawyer over the years, so we would not have other folks submitting Bankruptcy 13 when they do not want to.”

Go back to pre-COVID numbers

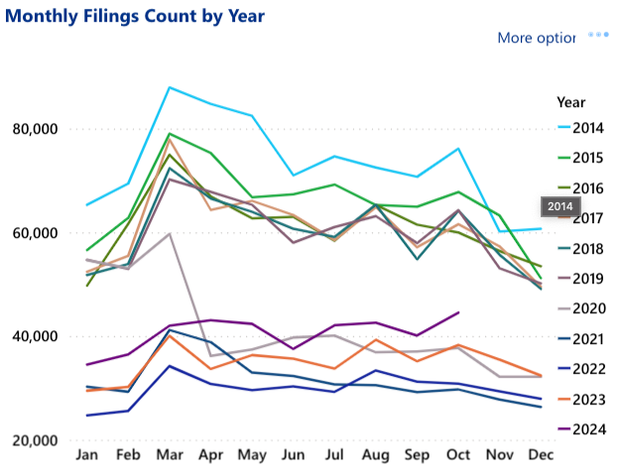

Non-public chapter filings averaged about 750,000 a 12 months ahead of COVID-19, however dropped off a cliff right through the pandemic, because of govt assist.

“It was once very constant from 2014 to 2019 — beautiful flat, after which the pandemic hit. Numerous us idea volumes would surge,” mentioned Michael Hunter, vp, industry construction, at Epiq Aacer. However there was once forbearance for pupil loans, automobiles and mortgages, he famous.

“Banks have been extending olive branches, and we noticed bankruptcies plummet to lower than part of pre-pandemic ranges,” he mentioned.

“There was once some huge cash sloshing round,” mentioned Lawless, mentioning govt stimulus techniques and different assist. “Other folks paid down their debt,” he mentioned.

Now, with the ones monetary lifelines in large part unplugged, U.S. families are tacking extra debt onto family steadiness sheets. “The most important marvel is chapter filings have not long past up much more,” mentioned Lawless, who expects a go back to pre-COVID ranges.

Nonbusiness chapter filings fell to beneath 400,000 ahead of edging again as much as 434,000 in 2023, in line with statistics revealed by means of the Administrative Workplace of the U.S. Courts. With two months left in 2024, private chapter filings stood at 405,132 on the finish of October.

“We are nonetheless beautiful some distance clear of the submitting numbers of 2019,” mentioned Foohey. “There was once a drastic drop on the time of the pandemic that endured for a number of years, which is now returning to pre-pandemic ranges.”