PA Media

PA MediaThe Chancellor Rachel Reeves is travelling to China in a bid to spice up business and financial ties, as she faces force over executive borrowing prices hitting their easiest degree in years.

The 3 day-visit has been criticised by means of some Conservatives who declare she will have to have cancelled the travel to prioritise coping with financial problems at house.

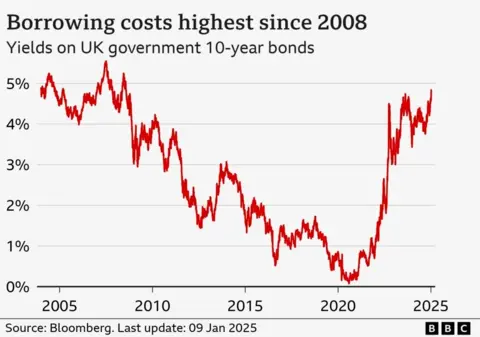

Govt borrowing prices have hit their easiest ranges for a number of years, that means that makes use of up extra tax earnings, leaving much less cash to spend on different issues.

Economists have warned this may imply spending cuts affecting public services and products or tax rises that would hit folks’s pay or companies’ talent to develop.

Travelling to China with the chancellor are senior monetary figures, together with the governor of the Financial institution of England and the chair of HSBC.

There she’s going to meet China’s Vice Premier He Lifeng in Beijing prior to flying to Shanghai for dialogue with UK corporations working in China.

The federal government is taking a look to restore an annual financial discussion with China that has no longer been held because the pandemic.

Ties were strained in recent times by means of rising issues in regards to the movements of China’s Communist leaders, allegations of Chinese language hacking and spying and its jailing of pro-democracy figures in Hong Kong.

The Conservatives have criticised the chancellor for continuing with the deliberate travel moderately than staying in the United Kingdom to handle the price of executive borrowing and slide within the price of the pound.

Shadow chancellor Mel Stride accused Reeves of being “lacking in motion” and mentioned she will have to have stayed in the United Kingdom.

However Leader Secretary to the Treasury Darren Jones, status in for Reeves within the Commons on Thursday, mentioned the travel was once “necessary” for UK business and there was once “little need for an emergency intervention”.

Former chancellor Philip Hammond additionally informed the International at One programme on Thursday that he “would not in my opinion suggest the chancellor cancels her travel to China. This may wait till she will get again subsequent week”.

Governments typically spend greater than they carry in tax in order that they borrow cash to fill the distance, generally by means of promoting bonds to buyers.

Rates of interest – referred to as the yield – on executive bonds were going up since round August, a upward push that has additionally affected executive bonds in america and different international locations.

The yield on a 10-year bond has surged to its easiest degree since 2008, whilst the yield on a 30-year bond is at its easiest since 1998, that means it prices the federal government extra to borrow over the longer term.

Reeves has up to now dedicated best to make important tax and spend bulletins annually on the autumn Price range.

But when upper borrowing prices persist, there’s the potential for cuts to spending prior to that or a minimum of decrease spending will increase than would differently occur.

Any longer spending cuts might be introduced within the chancellor’s deliberate fiscal commentary on 26 March , forward of a spending assessment that has already requested executive departments to search out potency financial savings price 5% in their budgets.