Getty Pictures

Getty PicturesUK inflation all of a sudden dipped in December for the primary time in 3 months as lodge costs fell and tobacco prices eased.

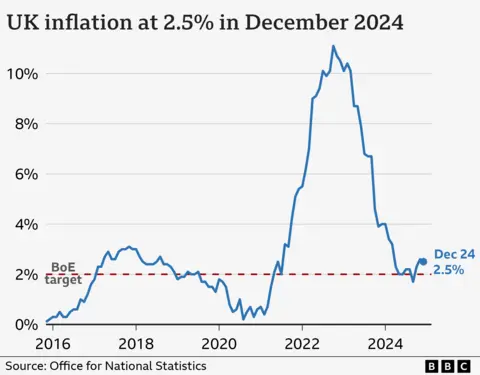

Costs rose 2.5% within the 12 months to December, down from 2.6% the month sooner than, the Place of business for Nationwide Statistics (ONS) stated.

In spite of the speed of value rises ultimate above the Financial institution of England’s goal, expectancies of an rates of interest lower subsequent month have grown.

The newest figures additionally ease force on Chancellor Rachel Reeves, who has confronted grievance following a fall within the worth of the pound and govt borrowing prices hitting the absolute best degree for a number of years.

Borrowing prices fell again to ultimate week’s ranges early on Wednesday and the pound rose fairly to face at $1.22 as investors reacted to the surprising inflation drop.

Easing value rises in eating places, falling lodge costs, and smaller rises in airfares than same old ultimate month helped the full inflation fee come down, the ONS stated.

Costs for tobacco merchandise, which come with cigarettes, pouches, vape refills and cigars, additionally larger at a slower tempo.

However Grant Fitzner, leader economist of the ONS, stated this used to be offset by way of the emerging price of gasoline and second-hand automobiles.

Inflation is far not up to its top in October 2022 when costs soared, pushing up the price of dwelling for families and main to better rates of interest, which has made the price of loans, bank cards and mortgages, costlier.

Falling inflation does now not imply costs are reducing, however at the moment are emerging at a slower tempo.

Economists had anticipated inflation to stay unchanged ultimate month, so the falling fee will likely be welcome information for Reeves.

She stated there used to be “nonetheless paintings to be achieved to assist households around the nation with the price of dwelling”, however added the federal government had “taken motion to offer protection to operating folks’s payslips from upper taxes” and larger the minimal salary.

Shadow chancellor Mel Stride stated financial enlargement were “killed stone lifeless by way of this govt” and known as for Reeves to “urgently provide an explanation for how she’s going to now accomplish that”.

According to turbulence within the markets, it’s understood the chancellor will carry ahead bulletins for Labour’s business technique.

Jane Sydenham, funding director at Rathbones Funding Control, stated a vulnerable pound tended to sign a “insecurity” in the United Kingdom financial system.

She instructed the BBC’s These days programme buyers had to “see some element” on the United Kingdom’s plans. “Are there going to be some tax breaks for sure industries? I feel specifics and motion is what the marketplace needs to peer,” she added.

Emerging borrowing prices have a knock-on impact at the govt’s tax and spending plans, as a result of it’ll must pay extra hobby to finance its present debt. That leaves much less to spend on public products and services and funding.

Darren Jones, leader secretary to the Treasury, instructed the BBC public products and services would “must reside inside their way”.

When pressed on whether or not that sounded as even though cuts had been at the method, he spoke back: “It is with reference to prioritisation.”

‘You’ll be able to best fee such a lot’

Jonny Gettings, director of operations at Italian eating place and small lodge Ennio’s in Southampton, instructed the BBC the hospitality trade used to be being hit by way of emerging prices from produce and components, to personnel wages and software expenses.

He stated the outlook for the trade seemed “significantly worse” with will increase to the minimal salary and nationwide insurance coverage contributions and discounts to trade charges aid at the horizon.

“Our personnel are our greatest asset and the concern is the balancing act is ensuring that we do not affect on their long run employment,” he stated.

Mr Gettings stated reducing personnel operating hours will be the “ultimate state of affairs”, however stated the eating place may just take a look at shrinking its menu dimension, overview its providers, or exchange opening hours.

“Once you build up the costs, you have got some other bunch of issues to take care of, as a result of then the concern is the shoppers will vote with their toes and they’re going to move and consume in different places,” he added.

“You’ll be able to best fee such a lot for a menu merchandise sooner than the visitor goes to mention, ‘neatly, cling on a minute’.”

‘Extra fee cuts’

Michael Saunders, a former member of the Financial institution of England’s financial coverage committee which units rates of interest, stated the most recent inflation determine could be “some assist” in looking to ease one of the vital worries over UK rates of interest.

“If it remains like this, we can be on path to fairly extra rate of interest cuts,” he instructed BBC’s These days programme.

The Financial institution of England made up our minds to carry rates of interest at 4.75% ultimate month, after policymakers stated the United Kingdom financial system had carried out worse than anticipated, with out a enlargement in any respect between October and December.

It is going to subsequent set charges in February, however inflation stays over the Financial institution’s 2% goal.

Then again, Ruth Gregory, deputy leader UK economist at Capital Economics stated the lower-than-expected inflation determine for December “strengthens the case” for a zero.25 share level lower subsequent month.