Getty Pictures

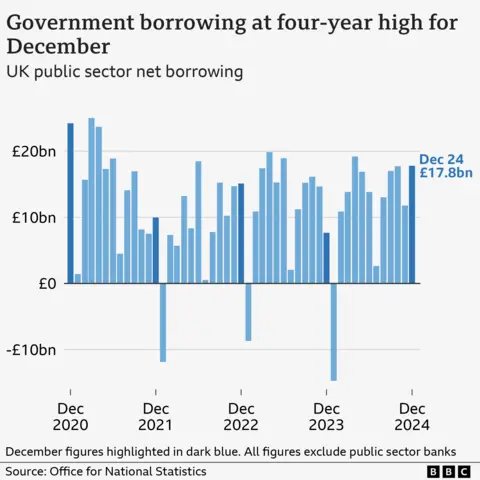

Getty PicturesGovt borrowing rose greater than anticipated in December, hitting its absolute best degree for the month for 4 years, legitimate figures display.

Borrowing – the variation between spending and tax earnings – was once £17.8bn final month, £10.1bn greater than in December 2023, the Workplace for Nationwide Statistics (ONS) stated.

Spending on public products and services, advantages, and debt pastime have been all up at the 12 months, the ONS stated, whilst an build up in tax take was once offset through a reduce to Nationwide Insurance coverage through the former govt.

The greater borrowing comes after rates of interest paid on govt debt surged previous this month sooner than falling again.

The spike in borrowing prices threatens the federal government’s financial plans, with Chancellor Rachel Reeves going through drive after figures final week confirmed the United Kingdom economic system had flatlined. The federal government has stated rising the economic system is its major precedence so as to spice up residing requirements.

Final month, the pastime charged on govt debt was once £8.3bn, which was once £3.8bn greater than it was once the 12 months sooner than.

The quantity marked the third-highest December debt pastime repayments since per thirty days information started in January 1997.

Alex Kerr, UK economist at Capital Economics, stated towards the backdrop of slow financial expansion and prime rates of interest, “December’s overshoot in borrowing is additional disappointing information for the chancellor”.

He stated the vast majority of the upper borrowing was once because of a one-off £1.7bn fee from the federal government to the non-public sector to repurchase army lodging.

The entire £17.8bn borrowed through the federal government was once a lot upper than the £14.6bn forecast Workplace for Funds Duty, the United Kingdom’s legitimate forecaster.

The quantity borrowed was once the third-highest for a December since per thirty days information started in 1993.

It manner, with many of the monetary 12 months long gone, the variation between what the federal government has spent and what it earns in taxes is £4bn greater than legitimate forecasts.

Then again, that determine comprises numerous estimates which might be continuously revised at a later date.

That is specifically true round this time of 12 months when a lot of people post self-assessment tax returns, which will increase the federal government’s earnings.

The newest figures will upload to hypothesis that Reeves, who has vowed to stay an “iron grip” at the public budget, may just reduce public spending.

Leader Secretary to the Treasury Darren Jones stated the federal government would “root out waste to verify each and every penny of taxpayer’s cash is spent productively”.

“Financial balance is essential for our primary undertaking of handing over expansion,” he added.

However Elliott Jordan-Doak, senior UK economist at Pantheon Macroeconomics, stated the upward push in the price for the federal government to borrow cash in addition to inflation, which is the speed costs upward thrust at through the years, heading again up, would “heap additional drive on govt spending”.

He stated he anticipated Reeves to stipulate public spending discounts in March, including that “additional tax will increase on the subsequent Funds in October could also be a excellent guess”.