Trade reporter, BBC Information

Getty Pictures

Getty PicturesProcess development in the United States slowed final month however unemployment remained low, in an indication of a cast, if extra subdued financial system.

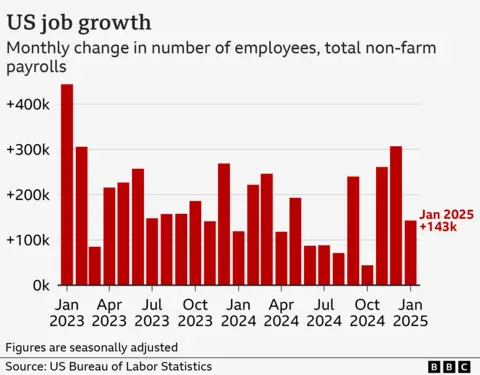

Employers added 143,000 jobs in January, whilst the unemployment charge slipped to 4% from 4.1%, in line with the Hard work Division record.

The figures set the degree as US President Donald Trump enters the White Area promising a big shake-up, together with cuts to govt spending and the federal group of workers, mass migrant deportations and better price lists on many items getting into the United States.

The proposals have raised uncertainty in regards to the trail forward for the sector’s biggest financial system.

Ultimate month, the United States central financial institution cited questions in regards to the long term because it introduced it could now not reduce rates of interest, hitting pause after a chain of cuts that had began in September.

Federal Reserve chairman Jerome Powell additionally stated the financial institution’s considerations in regards to the activity marketplace had subsided.

In spite of the slowdown in jobs development final month, analysts stated they didn’t see a lot within the report back to spark new worries, noting revisions to previous information indicating that activity development in November and December used to be more potent than up to now estimated.

“A lower-than-expected January payrolls quantity used to be greater than offset through upward revisions to November and December’s totals and a downtick within the unemployment charge,” stated Ellen Zentner, leader financial strategist for Morgan Stanley Wealth Control.

“Those that’d was hoping for a cushy record that might nudge the Fed again into rate-cutting mode did not get it.”

Employers in well being care and retail sectors drove the activity good points in January, which got here as the rustic used to be hit through wildfires and iciness storms.

Moderate hourly pay used to be up 4.1%, when put next with January 2023, in line with the record.

The record used to be suffering from annual revisions, which incorporate extra detailed information on activity development.

The ones confirmed fewer activity good points in 2024 general than up to now estimated. US stocks have been little modified after the inside track.

White Area spokeswoman Karoline Leavitt stated the record confirmed “the Biden financial system used to be some distance worse than any person concept, and underscores the need of President Trump’s pro-growth insurance policies”.

In spite of the revisions, the newest record recommended that the activity marketplace is extra strong than it used to be only some months in the past, stated Samuel Tombs, leader US economist for Pantheon Macroeconomics, which stated it used to be not anticipating the Fed to chop charges in March.

“All informed, the financial system created fewer jobs than we up to now concept final yr, however the development not seems to be deteriorating,” he stated.

He warned that the company nonetheless anticipated a “relapse” in jobs development “given the muted stage of hiring signs and increased uncertainty in regards to the new management’s financial insurance policies”.