Politics investigations correspondent

Politics manufacturer

BBC

BBCRachel Reeves has had a troublesome begin to her ministerial profession.

In addition to Labour’s new chancellor taking at the demanding situations of the United Kingdom financial system, she has confronted difficult questions on her previous.

They started with scrutiny of her on-line CV overdue closing yr.

At the skilled networking website LinkedIn, the Chancellor of the Exchequer claimed to have labored as an economist at Halifax Financial institution of Scotland (HBOS) right away sooner than turning into an MP.

A type of who challenged it used to be a retired former colleague, Kev Gillett.

In a public publish on LinkedIn, which he requested fans to percentage, he wrote: “Again in 2009 Rt Hon Rachel Reeves labored 3 ranges under me. Simply info. She used to be a Proceedings Reinforce Supervisor at LBG/HBOS. No longer an Economist. #factcheck.”

In reality it emerged that she had labored in a managerial position throughout the financial institution’s criticism dealing with division and her LinkedIn profile used to be up to date to take away the declare.

Gillett additionally made any other declare about Reeves’s time on the financial institution from 2006 to 2009, writing that she: “Just about were given sacked because of an bills scandal the place the three senior managers had been all signing off every others bills.”

Reeves’s workforce vigorously denied the allegations.

On the other hand, Labour’s drawing close victory in closing summer season’s common election precipitated a publish on a non-public Fb workforce for former HBOS staff that BBC Information has noticed asking if any person remembered Reeves.

One former worker answered: “the bills dept without a doubt do!”

A number of others made connection with Reeves being investigated over her bills spending.

BBC Information has been in quest of the reality in the back of those tips, talking to greater than 20 folks, lots of whom had been former colleagues, and having access to receipts, emails and different paperwork.

We now have learnt that there used to be an bills investigation into Reeves and two different senior managers.

An in depth six-page whistleblowing criticism and dozens of pages of connected proof, which we now have noticed, raised considerations that the 3 managers had been the usage of the financial institution’s cash to “fund a way of life” with allegedly beside the point spending on dinners, occasions, taxis and items, together with for every different.

We now have no longer been in a position to ascertain what the general consequence of the investigation used to be. Certainly it would possibly not have concluded.

However the preliminary a part of the investigation, which used to be carried out through Inside Audit on the request of the financial institution’s possibility division, discovered that the 3 managers gave the impression to have damaged the principles and the whistleblower’s allegations had been substantiated, in keeping with a senior supply with wisdom of the investigation.

A spokesman for Reeves stated the Chancellor had no wisdom of the investigation, all the time complied with bills laws and left the financial institution on just right phrases.

Banking profession

Reeves used to be in her 20s and looking to grow to be an MP when she took up a role at Halifax Financial institution of Scotland in West Yorkshire in 2006.

The position required her to transport north from London, the place she had unsuccessfully stood as Labour’s parliamentary candidate in what were a secure Conservative seat.

She first of all labored within the loan division, however in overdue 2007 moved to grow to be Head of Industry Making plans within the Buyer Family members division, which treated lawsuits.

Her profession at HBOS coincided with what would turn out to be a tumultuous time for the financial institution.

The worldwide monetary disaster which started in overdue summer season of 2007 would drive the sphere to embark on a large programme of activity cuts and price financial savings.

In September 2008, HBOS itself got here with reference to crumple, requiring a government-brokered takeover through Lloyds and an emergency bailout which might overall £20.5bn of taxpayers’ cash.

It used to be in a while after this near-collapse, through early 2009, {that a} whistleblower from her division raised considerations concerning the spending conduct of Reeves and two different managers, considered one of whom used to be Reeves’s boss.

Earlier than this, in overdue 2008, a memo used to be circulated to Reeves and others which referred to as for tighter price keep watch over within the division.

Written through a making plans and technique supervisor, the file, “Monetary Chance Keep watch over inside Buyer Family members”, raised considerations about “spending on shuttle” and on company spending playing cards, together with Motivation playing cards which have been used to praise crew.

It laid out proposals to “strengthen price controls” which integrated per 30 days discussions with Reeves and any other of the senior managers who the whistleblower claimed had mis-used bills to “give visibility of claims, invoices, Thank you card use and reviews”.

One after the other, Reeves used to be emailed in mid-December 2008 about proposals for a presentation surroundings out how a lot were spent on Motivation playing cards, recognising most sensible performers and on taxi shuttle, to “center of attention consideration on specific facets of shuttle which might be pricey and most likely want extra attention”.

Reeves answered to mention that she used to be no longer certain a “massive research” used to be wanted and she or he sought after to peer the papers sooner than they went any longer.

Whistleblower criticism and investigation

The whistleblower’s criticism submitted through early 2009 used to be a six-page file laying out a spread of considerations about an alleged spending tradition within the Buyer Family members division.

It targeted at the behaviour of 3 people: Reeves, Reeves’s boss, and any other senior supervisor within the division. Reeves’s boss, who we aren’t naming, used to be accountable for signing off the bills of the opposite two managers.

The document and connected receipts and different paperwork noticed through BBC Information display Reeves used to be accused of spending loads of kilos on purses, fragrance, earrings and wine for colleagues, together with one present for her boss. Worry used to be additionally expressed about her spending on taxis and on a Christmas birthday celebration. The whistleblower believed the spending to be over the top.

After a decision to the whistleblowing hotline, the whistleblower used to be urged at hand in a bodily reproduction in their document and supporting proof, two resources stated.

A separate supply, who contacted BBC Information themselves within the wake of a piece of writing at the furore round Reeves’s CV closing yr, used to be additionally conscious that anyone had blown the whistle on Reeves and any other colleague.

The document used to be handed to the financial institution’s possibility division and, at their request, used to be taken on through the Inside Audit division.

A supply who labored in possibility on the financial institution advised us: “Given the character of the allegations – claiming bills for issues you would not most often declare bills for – and the relative seniority of the people, the topic used to be referred for investigation through a workforce out of doors of that division.”

The Inside Audit division, which had get admission to to bills claims and sign-offs, then assessed the criticism and supporting paperwork, in keeping with two resources.

It discovered that there used to be proof of obvious wrongdoing through the 3 senior managers together with Reeves, a senior supply with direct wisdom of the investigation advised BBC Information.

Inside Audit finished its involvement within the investigation and handed its findings to an investigative a part of the Chance division in round April 2009. The traditional procedure would then were for the managers to be interviewed concerning the allegations. There would then be an review of possible disciplinary motion if vital.

On the other hand it does no longer seem that this subsequent interview level happened, or that the investigation ever reached a proper conclusion. Reeves insisted she used to be by no means interviewed, as did her boss, who stated she used to be “no longer acutely aware of an bills probe and my departure used to be no longer associated with any alleged investigation”. The opposite senior supervisor declined to remark.

There is not any proof of which we’re conscious that the financial institution’s inner investigation used to be finished, or that there used to be ever a concluding discovering of any wrongdoing.

Reeves left the financial institution in Might 2009, as did her boss. The opposite senior supervisor used to be on unwell go away in Might and not returned to paintings on the financial institution.

There is not any advice any of the departures had been connected to the investigation or spending problems and a spokesman for Reeves stated the Chancellor left the financial institution on just right phrases.

In addition they equipped a commentary from the legal professional who equipped prison recommendation at the compromise settlement – a voluntary prison file finishing an worker’s employment – she signed on her departure.

He stated it used to be a “standard-style settlement followed through the corporate when a mutually agreed go out used to be made all the way through the financial institution’s restructure”.

“Completely no allegations of wrongdoing or misconduct had been discussed through the HBOS HR workforce all the way through this procedure,” he stated.

Bills allegations

What lay in the back of the whistleblower’s criticism and the grumbles of alternative colleagues used to be disappointment in terms of a number of other spaces of spending.

One worry used to be the usage of financial institution fee playing cards to pay for Christmas and birthday items.

“A tradition evolved amongst senior managers in Buyer Family members the place items got freely to direct reviews – each upwards and downwards,” one former colleague of Reeves claimed.

“[They had] an excessively cavalier angle in regards to the finances within the division.”

Reeves and the opposite senior managers had each a company bank card and any other fee card referred to as a ‘Motivation’ or ‘Thank you’ card.

The Motivation card used to be meant for use to praise high-performers for just right paintings.

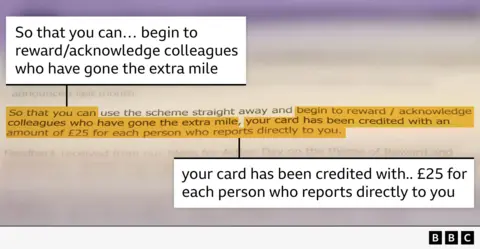

There used to be steering about its use. In February 2008 a memo urged HBOS staff on the proper use of Motivation playing cards, which have been extensively used throughout the Buyer Family members division.

It mentioned that the playing cards had been for use to “praise/recognize colleagues who’ve long gone the additional mile”.

Urged items integrated “sweets, vegetation, wine, vouchers or you need to merely go surfing and ship a loose e-card to mention ‘Thank you’ for a role smartly completed”, the memo stated.

It warned that managers could be “accountable for all transactions to your card and might be held responsible if spending to your commentary can’t be verified”.

Spending on this space used to be scrutinised for the reason that corporate incurred tax on it.

The memo does not explicitly limit Christmas and birthday items.

However 11 former staff advised us that they had by no means heard of work-mates being purchased birthday items with the financial institution’s cash, and believed that doing so used to be in breach of the principles. A number of stated any birthday items had been purchased with their very own cash.

On the other hand, one ex-staff member, Jane Wayper, a former HR trade spouse who used to be given permission to talk to us through Reeves’s workforce, claimed that “birthday items and Christmas gifts may well be bought the usage of Motivation playing cards” and “crew had been inspired to take action for his or her groups”.

Reeves purchased birthday gifts for colleagues with HBOS’s cash all through her time in Buyer Family members, receipts display, with purchases together with wine and cosmetics. Some had been purchased the usage of a Motivation card, whilst others had been reimbursed via an bills declare.

She additionally spent £152 on a purse and fragrance as a gift for her boss the usage of the financial institution’s cash, in keeping with the whistleblower’s document. The existing used to be a joint present from Reeves and one of the most different managers who used to be later investigated along her.

And he or she purchased earrings as a gift for her PA, which she claimed again on bills.

Her PA, Linda Barrowclough, stated she had won Christmas and birthday items from Reeves however had assumed they had been “non-public items [and] they might have pop out of her personal pocket”.

Reeves extensively utilized her Motivation card to spend greater than £400 on a leaving meal for a colleague, which the whistleblowing criticism claimed used to be no longer a approved use.

Christmas items

The placement round Christmas items, which Reeves additionally purchased for her PA and others, used to be extra difficult.

That is as a result of, in keeping with inner financial institution steering we now have noticed, those may well be purchased on bills offering they had been small items of £25 or much less they usually weren’t purchased the usage of the Motivation card.

The £25 prohibit used to be in response to tax recommendation as anything else extra considerable would draw in tax.

It gave the impression to her colleagues that Reeves had damaged those laws.

However there does seem to have been confusion concerning the coverage. We now have additionally noticed emails appearing that Reeves used to be inspired through her boss to shop for costlier Christmas gifts, and to pay for them together with her Motivation card.

In overdue October 2008, Reeves’s supervisor wrote that “after checking with different departments, it seems like the usual apply of shopping for Christmas items for direct reviews the usage of motivation financial institution will proceed this yr”, emails noticed through the BBC display.

She steered spending £50 to £75 according to individual at the gifts.

A reminder titled “additional readability” about how to shop for Christmas items and what sort of to spend used to be circulated through any other HBOS worker in early December, emails display.

Reeves and the opposite managers who had been later investigated had been all a few of the recipients of this e-mail confirming the principles on Christmas items.

Whilst seasonal items, comparable to at Christmas, had been allowed, the managers had been explicitly advised they may no longer use Motivation playing cards for those purchases. The price of those “trivial” items used to be additionally no longer allowed to exceed £25, in keeping with HMRC steering, the e-mail stated.

It is because rewards for efficiency at paintings are taxable while seasonal items comparable to the ones given for Christmas, offering they don’t seem to be too pricey, are exempt.

Replying to the e-mail, Reeves wrote that she did not perceive why the “objective posts are moving” and stated she had already ordered and paid for her gifts the usage of “Motivation Financial institution/Thank you, and I don’t intend to cancel them,” claiming this could price extra money and time.

A colleague accountable for finance stated that the message on paying for Christmas items hadn’t all the time been transparent however stated: “I do not consider that the goalposts are being moved.”

Receipts display that items purchased through Reeves at Christmas 2008 integrated a £49 purse for her PA, whilst she herself won £55 price of wine from her boss.

Open secret?

There used to be a in style trust on the financial institution that there were an bills investigation into Reeves and two colleagues.

However Reeves has stated that she has no recollection of being investigated or having questions raised over her bills.

A spokesman for Reeves stated she used to be “happy with the paintings she did at HBOS” and used to be no longer acutely aware of the claims about her bills till approached through the BBC.

“She used to be no longer acutely aware of an investigation nor used to be she interviewed, and she or he didn’t face any disciplinary motion in this or every other issues. All bills had been submitted and signed off in the correct manner,” she stated.

The spokesman additionally stated Reeves left in 2009 “on just right phrases and won a severance fee, together with her complete realize pay and bonus”.

“HBOS allowed her to stay an organization automotive for 6 months after she left and she or he used to be given a beneficial reference.”

Reeves’s workforce put ahead a number of formal HBOS staff for interview who they stated corroborated her account that she had no longer been investigated.

One stated she hadn’t noticed proof of senior managers misusing bills and the financial institution had controls to stop it however she left in February 2008, greater than a yr sooner than Reeves departed. She additionally stated that she had by no means heard of giving birthday and Christmas items at HBOS’s expense as being a part of the financial institution’s insurance policies.

Any other, Jane Wayper, the previous HR trade spouse, stated in a commentary that she did not recognise the accusations towards Reeves and “would were acutely aware of any investigation which concluded there used to be a case to respond to” as she would were concerned within the disciplinary procedure.

She stated there used to be “intensive oversight of all bills insurance policies” and claimed that “birthday items and Christmas gifts may well be bought the usage of Motivation playing cards”. However that is at odds with a file noticed through BBC Information and the testimony of eleven resources we now have spoken to.

Lots of Reeves’ former HBOS colleagues had been nervous concerning the penalties of sharing confidential data with BBC Information however consider it’s within the public hobby for what came about, and their considerations concerning the now-Chancellor’s spending of the financial institution’s cash, to be reported.

However, given their considerations about talking out publicly, we now have agreed to not identify them.

A Downing Boulevard spokesman stated the high minister had no considerations about Reeves’s habits.

Requested whether or not Sir Keir Starmer nonetheless idea the Chancellor had integrity after she up to date her profession historical past on LinkedIn, his legit spokesman stated: “Sure. The Chancellor and the high minister are running hand in hand to ship at the priorities, the plan for exchange, and to ship the upper enlargement and the enhancements in dwelling requirements that the rustic wishes.”

The Quantity 10 legit added that the chancellor had long gone during the declaration procedure, which all contributors of Cupboard undergo, when requested if she disclosed that there were an investigation into her bills sooner than she used to be an MP.

Conservative chief Kemi Badenoch stated the investigation raised questions for the chancellor.

She posted on X: “Keir Starmer stated ‘restoring accept as true with in politics is the nice take a look at of our generation’. Till she [Reeves] comes blank – no longer with reference to her CV however concerning the instances by which she left HBOS, no person will take him critically.”

The investigation at HBOS used to be no longer the closing time Reeves would face scrutiny over her bills.

In 2015, it emerged that she used to be amongst 19 MPs who had had their legit bank cards suspended through the parliamentary bills watchdog after failing to turn their spending used to be legitimate.

Reeves owed greater than £4,000 in spending on the time when her card used to be blocked. She due to this fact cleared her debt.

You probably have any data on tales you want to percentage with the BBC Politics Investigations workforce, please get involved at politicsinvestigations@bbc.co.united kingdom