Trade reporter, BBC Information

BBC

BBCGovt price range confirmed a big surplus closing month after a surge in tax receipts however the determine overlooked reliable forecasts, expanding drive on Chancellor Rachel Reeves to satisfy her personal fiscal regulations.

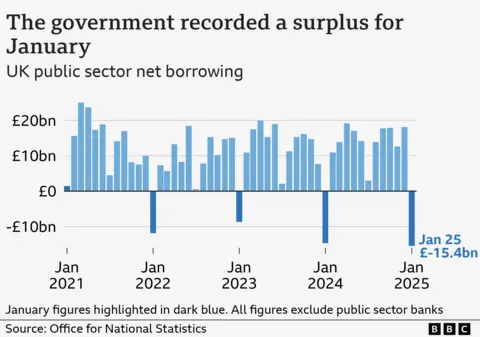

The excess – the variation between what the federal government spends and the tax it takes in – used to be £15.4bn in January, which is the perfect stage for the month since data started greater than 3 many years in the past.

Alternatively, the Place of job for Price range Accountability (OBR), which displays the federal government’s spending plans and function, had predicted that the excess can be upper at £20.5bn.

The smaller determine has added to rising hypothesis that Reeves will both have to chop public spending or carry taxes additional to satisfy her self-imposed regulations for the economic system.

The OBR will free up its newest outlook for the United Kingdom economic system and public price range on 26 March, when it is going to element what headroom the chancellor has. On the identical time, Reeves will announce her Spring Forecast.

Closing October, the watchdog mentioned she had £9.9bn in headroom to satisfy her regulations following her first Price range.

Alternatively, susceptible financial expansion and better borrowing prices have weighed on that wriggle room.

“In an effort to meet her fiscal regulations, the chancellor will want to carry taxes and/or minimize spending,” mentioned Alex Kerr, UK economist at Capital Economics, who added that the headroom were “burnt up”.

He mentioned Reeves’s choices forward of her Spring Forecast had been already “bleak” ahead of the “ratcheting up of drive on Ecu governments to extend defence spending” amid uncertainty over the result of the warfare in Ukraine.

Fiscal regulations are self-imposed by means of maximum governments in rich countries and are designed to take care of credibility with monetary markets.

There was hypothesis that if the chancellor desires to keep away from breaking her personal regulations, cuts in public spending or additional tax rises may well be introduced.

Cara Pacitti, senior economist on the Solution Basis suppose tank, mentioned contemporary financial knowledge “may go away the chancellor within the unenviable place of wanting to lift taxes or minimize spending to satisfy her fiscal regulations”.

The tricky choices confronted by means of Reeves come as UK financial expansion has proved anaemic, and inflation – which measures the speed that costs move up by means of – has risen, hanging drive on family budgets. The chancellor has in the past dominated out borrowing extra or elevating taxes once more, which issues to spending cuts.

Following the most recent executive finance figures, Darren Jones, leader secretary to the Treasury, reiterated that the federal government’s fiscal regulations had been “non-negotiable”.

The federal government has a tendency to take extra in tax than it spends in January when put next with different occasions of the 12 months because of the volume it receives in self-assessed taxes within the month.

In spite of closing month’s £15.4bn being a document determine for a surplus, it undershot forecasts because of lower-than-expected tax receipts, suggesting weak point in the United Kingdom economic system.

The Place of job for Nationwide Statistics (ONS) mentioned borrowing within the monetary 12 months to January 2025 used to be £118.2bn, some £11.6bn greater than on the identical level within the closing 12 months.

Spending on public services and products, advantages and debt pastime had been all upper than closing 12 months, the ONS added.

Liz Martins, senior UK economist at HSBC, instructed the BBC’s Lately Programme the upper borrowing used to be a “little bit being concerned”, including “if we are off monitor now the OBR may pass judgement on that that is going to persist”.

She added if the watchdog concept borrowing would stay increased “then the federal government may want to make additional adjustments” on its spending and taxation insurance policies.

Separate figures from the ONS confirmed retail gross sales in the United Kingdom rebounded in January, in large part because of sturdy meals gross sales.

However clothes retail outlets and family items reported “lacklustre gross sales because of susceptible shopper self assurance”, in line with ONS senior statistician Hannah Finselbach.

She mentioned gross sales in retail outlets had fallen over the last 3 months, and had been under pre-Covid ranges.

{name}

{content material}