Getty Pictures

Getty PicturesAll through his election marketing campaign closing yr, Donald Trump promised American citizens he would herald a brand new generation of prosperity.

Now two months into his presidency, he is portray a rather other image.

He has warned that it’ll be arduous to convey down costs and the general public will have to be ready for a “little disturbance” earlier than he can convey again wealth to the United States.

In the meantime, analysts say the percentages of a downturn are expanding, pointing to his insurance policies.

So is Trump about to cause a recession on the earth’s greatest economic system?

Markets fall and recession dangers upward thrust

In the United States, a recession is outlined as a chronic and fashionable decline in financial task normally characterized by means of a leap in unemployment and fall in earning.

A refrain of monetary analysts have warned in fresh days that the hazards of one of these state of affairs are emerging.

A JP Morgan record put the risk of recession at 40%, up from 30% in the beginning of the yr, caution that US coverage was once “tilting clear of expansion”, whilst Mark Zandi, leader economist at Moody’s Analytics, upped the percentages from 15% to 35%, mentioning price lists.

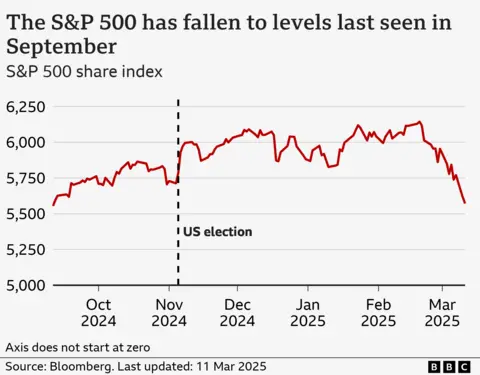

The forecasts got here because the S&P 500, which tracks 500 of the most important corporations in the United States sank sharply. It has now fallen to its lowest degree since September in an indication of fears concerning the long run.

The marketplace turmoil is being pushed in part by means of issues about new taxes on imports, known as price lists, which Trump has offered since he took place of work.

He has hit merchandise from The us’s 3 largest business companions with the brand new tasks, and threatened them extra broadly in strikes that analysts consider will building up costs and curb expansion.

Trump and his financial advisers were caution the general public to be ready for some financial ache, whilst showing to push aside the marketplace issues – a marked trade from his first time period, when he regularly cited the inventory marketplace as a measure of his personal luck.

“There’ll at all times be adjustments and changes,” he stated closing week, in line with pleas from companies for extra simple task.

The posture has higher investor worries about his plans.

Goldman Sachs closing week raised its recession bets from 15% to twenty%, announcing it noticed coverage adjustments as “the important thing chance” to the economic system. However it famous that the White Space nonetheless had “the solution to pull again if the drawback dangers start to glance extra severe”.

“If the White Space remained dedicated to its insurance policies even within the face of a lot worse knowledge, recession chance would upward thrust additional,” the company’s analysts warned.

Price lists, uncertainty and slowing expansion

For plenty of companies, the most important query mark is price lists, which lift prices for US companies by means of hanging taxes on imports. As Trump unveils tariff plans, many corporations at the moment are dealing with decrease benefit margins, whilst keeping off on investments and hiring as they are attempting to determine what the longer term will seem like.

Buyers also are fearful about giant cuts to the federal government personnel and executive spending.

Brian Gardner, leader of Washington coverage technique on the funding financial institution Stifel, stated companies and buyers had idea Trump meant price lists as a negotiating instrument.

“However what the president and his cupboard are signalling is if truth be told a larger deal. It is a restructuring of the American economic system,” he stated. “And that’s the reason what is been using markets within the closing couple of weeks.”

The USA economic system was once already present process a slowdown, engineered partly by means of the central financial institution, which has saved rates of interest upper to take a look at to chill task and stabilise costs.

In fresh weeks, some knowledge suggests a extra fast weakening.

Retail gross sales fell in February, self assurance – which had popped after Trump’s election on a number of surveys of shoppers and companies – has fallen, and firms together with primary airways, outlets equivalent to Walmart and Goal, and producers are caution of a pullback.

Some analysts are fearful a drop within the inventory marketplace may just cause an additional clampdown in spending, particularly amongst upper source of revenue families.

That might ship a big hit to the United States economic system, which is pushed by means of client spending and has grown more and more depending on the ones richer families, as decrease source of revenue households face power from inflation.

The top of the United States central financial institution, Jerome Powell, presented assurances in a speech closing week, noting that sentiment had no longer been a just right indicator of behaviour lately.

“In spite of increased ranges of uncertainty, the United States economic system remains to be in a just right position,” he stated.

However the United States economic system is these days deeply connected to the remainder of the arena, warned Kathleen Brooks, analysis director at XTB.

“The truth that price lists may just disrupt that on the identical time that there have been indicators that the United States economic system was once weakening anyway .. is actually fuelling recession fears,” she says.

Inventory marketplace in tech ripe for correction

The unease within the inventory marketplace is not all about Trump.

Buyers had been already jittery about the opportunity of a correction, after giant beneficial properties over the past two years, pushed by means of the pointy run-up in tech shares fuelled by means of investor optimism about synthetic intelligence (AI),

Chipmaker Nvidia, as an example, noticed its proportion worth leap from not up to $15 in the beginning of 2023 to almost $150 in November of closing yr.

That form of upward thrust had stirred debate about an “AI bubble” – with buyers on top alert for indicators of it bursting, which might have a large have an effect on at the inventory marketplace, irrespective of the dynamics within the wider economic system.

Now, with perspectives of the United States economic system darkening, optimism about AI is getting even tougher to maintain.

Tech analyst Gene Munster of Deepwater Asset Control wrote on social media this week that his optimism had “taken a step again” as the risk of a recession higher “measurably” over the last month.

“The secret is that if we input a recession, it’ll be extraordinarily tough for the AI business to proceed,” he stated.

{identify}

{content material}