Getty Pictures

Getty PicturesAdjustments to a key incapacity receive advantages known as Non-public Independence Fee (PIP) are being thought to be through the federal government because it tries to chop welfare spending.

PIP is paid to those who have problem finishing on a regular basis duties or getting round on account of a long-term bodily or psychological well being situation.

Sir Keir Starmer is dealing with power from some MPs and charities, who say prone other people may just lose out if the foundations for qualifying are tightened or bills modified.

How a lot is a PIP value?

There are two components to PIP – a day by day dwelling part and a mobility part. Claimants could also be eligible for one or each.

Day by day dwelling covers spaces akin to requiring lend a hand with getting ready meals, washing, studying and managing your cash. The mobility component comprises bodily transferring round or getting out of your house.

For each and every, there are two classes of fee – same old and, for the ones with higher wishes, enhanced.

For day by day dwelling:

- The usual price is £72.65 every week

- The improved price is £108.55 every week

For mobility:

- The usual price is £28.70 every week

- The improved price is £75.75 every week

PIP is generally paid each and every 4 weeks and is tax-free.

It does no longer trade relying to your source of revenue and does no longer depend as source of revenue affecting different advantages, or the receive advantages cap. You’ll get PIP if you’re operating.

The fee is made for a hard and fast time frame between one and 10 years, and then it’s reviewed. A reassessment may just come previous if your cases trade.

What number of people obtain PIP and who qualifies?

Greater than 3.6 million other people these days declare PIP.

The bills are made in England, Wales and Northern Eire. In Scotland, there’s a identical however separate receive advantages known as the Grownup Incapacity Fee.

Claimants are assessed and scored for the way a lot lend a hand is wanted for each and every of a sequence of day by day dwelling and mobility duties, in a procedure which has precipitated really extensive debate and controversy.

A ranking of between 8 and 11 ends up in fee of the usual price. The improved price is paid to these with a ranking of 12 and above.

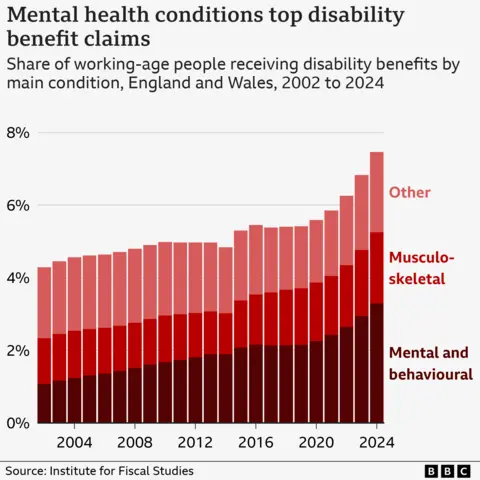

About 1.3m other people now declare incapacity advantages basically for psychological well being or behavioural stipulations akin to ADHD. This is 44% of all operating age claimants, in line with the impartial financial think-tank, the Institute for Fiscal Research (IFS).

How would possibly the foundations be modified?

When PIP used to be presented in 2013, the purpose used to be to save lots of £1.4bn a yr through decreasing the choice of other people eligible for bills.

Then again, preliminary financial savings have been modest and the choice of claimants has risen.

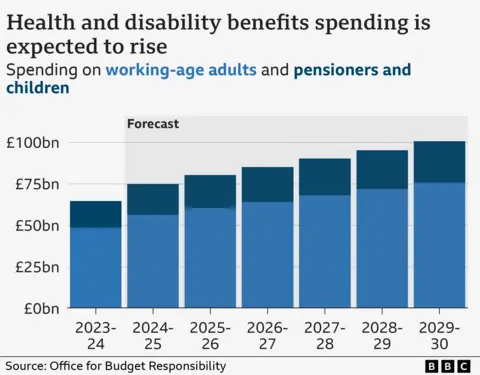

PIP is now the second-largest component of the working-age welfare invoice, with spending anticipated to just about double to £34bn through 2029-30.

Total, the federal government these days spends £65bn a yr on well being and disability-related advantages. That is projected to extend to £100bn through 2029.

Because of this, there’s a push through ministers to make adjustments and inspire other people into paintings.

First of all, it used to be idea they won’t build up PIP bills in step with inflation for a yr – however that concept is assumed to had been withdrawn after Labour MPs voiced opposition.

An alternative choice could be to tighten the factors, through converting the scoring device for many who qualify.

What about choices with different advantages?

Even if a lot of the focal point is on PIP the federal government might also make a decision to make adjustments to different advantages.

Common Credit score is the most important working-age receive advantages, paid to 7.5 million individuals who might, or would possibly not, be in paintings.

Greater than 3 million recipients of Common Credit score haven’t any requirement to search out paintings, a host that has risen sharply.

The federal government says that is unsustainable and that it desires to lend a hand extra other people into jobs.

{identify}

{content material}