Industry editor, BBC Information

Getty Photographs

Getty PhotographsTaxpayers and the pension schemes of Thames Water staff would each endure if the United Kingdom’s greatest water corporate used to be quickly nationalised, the water regulator and Thames’ pension trustees have warned.

Ofwat has no longer disputed that striking Thames beneath executive keep an eye on within the tournament the debt-laden corporate collapsed may just finally end up costing taxpayers billions of kilos.

Some 12,000 present and previous staff may just additionally see long term pension entitlements diminished, in keeping with paperwork noticed via the BBC.

The way forward for Thames Water is within the stability because the Court docket of Enchantment considers whether or not a £3bn emergency mortgage to the stricken software massive can pass forward.

Thames and the vast majority of its lenders have subsidized a plan that might see the corporate, which has a £20bn debt pile, borrow an additional £3bn to stay it afloat lengthy sufficient to finish a restructure.

The provider serves a few quarter of the United Kingdom’s inhabitants, most commonly throughout London and portions of southern England, and employs 8,000 other folks. It’s anticipated to expire of money utterly via mid-April.

The £3bn rescue mortgage used to be licensed following a a very powerful Top Court docket fight closing month, however a smaller crew of lenders anxious they stood to lose probably the most and Liberal Democrat MP Charlie Maynard, who argued that piling on extra debt used to be no longer within the public passion, introduced an enchantment.

The Court docket of Enchantment has been listening to arguments over whether or not the mortgage must be granted, with a choice anticipated early subsequent week.

Paperwork noticed via the BBC printed Ofwat rejected claims from Maynard that Thames including to its debt pile would imply upper expenses and likewise {that a} cave in into management would lead to a negligible price to taxpayers.

In a letter to the court docket, the water regulator insisted that Thames can be barred from convalescing any further passion bills from buyer expenses.

It stated that it had noticed “no proof to beef up” a determine put ahead via Maynard that management would price the federal government as low as £66m.

The regulator didn’t touch upon Thames’s estimate that it could price taxpayers as much as £4bn.

Surroundings Secretary Steve Reed has up to now stated executive intervention in Thames Water would “price billions and take years”.

One at a time, the trustees for some 12,000 Thames Water pension scheme participants have expressed fear that they “might be considerably and detrimentally impacted” must the corporate input management.

If Thames had been to cave in, the ones participants would most probably be transferred to the lifeboat Pension Coverage Fund, which gives decrease long term advantages than the ones promised via the unique scheme.

Thames is hoping that the extra £3bn in borrowing will supply it with sufficient time to start out addressing the various issues it has.

The corporate has confronted heavy grievance over its efficiency in recent times following a chain of sewage discharges and leaks.

For the reason that dire state of the corporate’s funds first emerged about 18 months in the past, the federal government has been on standby to place Thames into particular management.

However without reference to what occurs to the corporate sooner or later, water provides and waste products and services to families will proceed as standard.

The corporate’s first precedence, if the mortgage is licensed, can be to cut back its massive debt pile, via requiring lenders to simply accept a bargain in what they’re owed.

2d can be to enchantment a choice via Ofwat that it might probably simplest elevate expenses via 35% above inflation over the following 5 years. Thames has argued it wishes to extend via 53% over the duration.

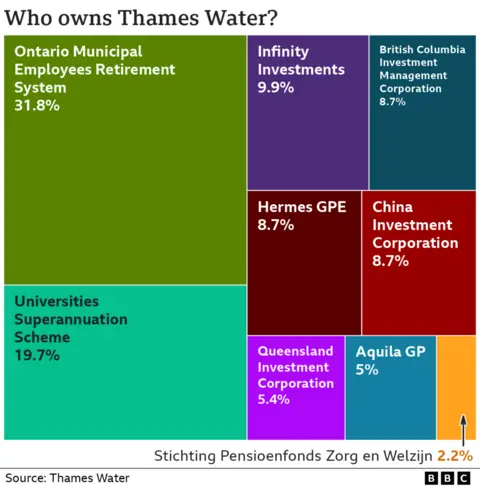

Its 3rd transfer, which is attached to either one of the above, can be to draw new traders to pump cash right into a trade that has attracted public anger and regulatory fines.

Whilst the federal government, the regulator and the pension trustees are willing to steer clear of a cave in, there are lots of who assume that Thames Water must be put out of its distress – slightly than lurching from one monetary and operational disaster to every other.

What Ofwat and the pension trustees indicate is this is prone to come at a value to each taxpayers and staff.

Supply hyperlink

{identify}

{content material}