China correspondent

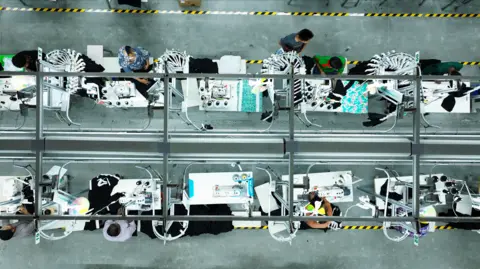

A hiss and puff of compressed air shapes the sleek leather-based, bringing to existence an all-American cowboy boot in a manufacturing facility on China’s jap coast.

Then comes any other one because the meeting line continues, the sounds of stitching, sewing, reducing and soldering echoing off the excessive ceilings.

“We used to promote round one million pairs of shoes a yr,” says the 45-year-old gross sales supervisor, Mr Peng, who didn’t want to divulge his first identify.

This is, till Donald Trump got here alongside.

A slew of price lists in his first presidential time period caused a business conflict between the sector’s two biggest economies. Six years on, Chinese language companies are bracing themselves for a sequel now that he’s again within the White Space.

“What route will have to we take sooner or later?” Mr Peng asks, unsure of what Trump 2.0 approach for him, his colleagues – and China.

A struggle looms

For Western markets which might be an increasing number of cautious of Beijing’s ambitions, business has transform an impressive bargaining chip – particularly as a slow Chinese language financial system is predicated ever extra on exports. Trump returned on a marketing campaign promise that integrated crushing price lists in opposition to Chinese language-made items, and has since threatened a ten% levy this is anticipated to take impact on 1 February.

He has additionally ordered a evaluation of US-China business – which buys Beijing time and Washington, negotiating room. And for now, harsher rhetoric (and better price lists) appears to be directed in opposition to US allies corresponding to Canada and Mexico.

Trump could have pressed pause at the looming struggle with Beijing. However many consider it is nonetheless coming. It is exhausting to seek out an actual determine on what number of companies are fleeing China, however primary companies corresponding to Nike, Adidas and Puma have already relocated to Vietnam. Chinese language companies too had been shifting, reshaping provide chains, even if Beijing stays a key participant.

Mr Peng says his boss, who owns the manufacturing facility, has thought to be shifting manufacturing to South East Asia, in conjunction with many in their competition.

It could save the company, however they might lose their personnel. Many of the workforce are from the close by town of Nantong and feature labored right here for greater than two decades.

Mr Peng, whose spouse died when their son was once younger, says the manufacturing facility has been his circle of relatives: “Our boss is decided to not abandon those staff.”

Xiqing Wang/ BBC

Xiqing Wang/ BBCHe’s conscious about the geopolitics at play, however he says he and his employees are simply looking to make a dwelling. They’re nonetheless reeling from the affect of 2019, when a fourth spherical of Trump price lists – 15% – hit Chinese language-made client items, corresponding to garments and sneakers.

Orders have since dwindled and workforce numbers, another time than 500, have dropped to only over 200. The proof is within the empty paintings stations, as Mr Peng presentations us round.

Throughout him, employees are reducing the leather-based into the appropriate form handy it to the machinist. They must be actual as a result of errors will destroy the pricy leather-based, maximum of which has been imported from america.

The manufacturing facility is attempting to stay prices low as a few of their American patrons are already making an allowance for shifting trade clear of China and the specter of price lists.

However that may imply shedding professional employees: it might take as much as every week to make one pair of shoes, from knocking down the leather-based to giving the completed boots a last polish and packing them for export.

That is what became China into the sector’s peak producer – labour-intensive manufacturing which could also be reasonable when it is scaled up and supported through an unrivalled provide chain. And this has been years within the making.

“It was once as soon as a continuing cycle of analyzing items and transport them out – I felt fulfilled,” says Mr Peng, who has labored right here since 2015. “However orders have diminished, which makes me really feel somewhat misplaced and concerned.”

As soon as crafted to triumph over the Wild West, those cowboy boots had been made right here for greater than a decade. And this can be a acquainted tale within the south of Jiangsu province, a producing hub alongside the Yangtze River that produces almost about the entirety, from textiles to electrical automobiles.

Xiqing Wang/ BBC

Xiqing Wang/ BBCThose are a few of the loads of billions of bucks value of products that China ships to america yearly – a host that continuously ballooned as Washington changed into its greatest buying and selling spouse.

That standing slipped below Trump. But it surely was once no longer restored below his successor Joe Biden, who stored maximum Trump-era price lists in position, as ties with Beijing frayed.

Actually, the Ecu Union too has imposed price lists on electrical car imports, accusing China of constructing an excessive amount of, steadily with the toughen of state subsidies. Trump has echoed this – that China’s “unfair” business practices downside international comeptitors.

Beijing sees such rhetoric as Western makes an attempt to stifle its expansion, and it has time and again warned Washington that there shall be no winners in a business conflict. But it surely has additionally stated it is in a position to speak and “correctly deal with variations”.

And President Trump, who has described price lists as his “one giant energy” over China, surely desires to speak.

It is unclear as but what he may need in go back. Throughout Trump’s honeymoon length with China in his first time period he got here to Beijing to invite for Xi’s lend a hand in assembly North Korea’s chief Kim Jong Un. This time it’s believed he may want Xi’s toughen to make a take care of Russian President Vladimir Putin to finish the conflict in Ukraine. He just lately stated that China had “a substantial amount of energy over that scenario”.

The specter of a ten% tariff is pushed through the conclusion that China is “sending fentanyl to Mexico and Canada”. So he may call for that it do extra to finish that glide.

Or, given he welcomed a bidding conflict over TikTok, he might need to negotiate its possession – or the prized era that powers the app – as a result of Beijing would wish to conform to this type of sale.

Xiqing Wang/BBC

Xiqing Wang/BBCRegardless of the deal is also, it will lend a hand reset US-China ties. Then again, the absence of 1 may hastily finish the danger of a 2d honeymoon, putting in Trump and Xi for a much more confrontational courting.

Already trade sentiment is anxious: an annual survey through the American Chamber of Trade in China confirmed simply over part of them had been involved in regards to the US-China courting deteriorating additional.

Trump’s apparently softer stance on China provides some reduction. However his hope continues to be that the specter of price lists will lend a hand power patrons clear of China and transfer production again to america.

Some Chinese language companies are certainly at the transfer – however to not The usa.

Transferring store

An hour out of doors Cambodia’s capital Phnom Penh, businessman Huang Zhaodong has constructed a brand new manufacturing facility to cater to a flood of orders from US giants Walmart and Costco.

That is his 2d manufacturing facility in Cambodia, and in combination they produce part one million clothes a month, from shirts to lingerie. Hangers sporting cotton trousers roll previous us on an automatic line, shifting from one station to the following because the elastic waist is inserted and hemlines are completed.

Xiqing Wang/ BBC

Xiqing Wang/ BBCNow, when potential US shoppers lob the primary query, which he has come to be expecting – the place is he based totally – Mr Huang has the appropriate solution. No longer in China.

“Relating to some Chinese language companies, their shoppers have instructed them: ‘If you do not transfer manufacturing out of the country, I’m going to cancel your orders’.”

The price lists carry tricky possible choices for providers and shops, however it isn’t at all times transparent who will undergo the brunt of the associated fee. On occasion it’s going to be the client, Mr Huang says.

“Take Walmart for example. I promote them garments at $5, however they generally mark it up 3.5 occasions. If the associated fee will increase because of upper price lists, the fee I promote to them may upward push to $6. In the event that they mark it up through 3.5 occasions, the retail value would build up.”

However generally, he says, it’s the provider. If his manufacturing line was once in China, he estimates an additional 10% tariff may take an additional $800,000 (£644,000) from his income.

“That is greater than what I make as benefit. It is large and we will be able to’t have enough money it. If you are making garments in China below such tariff stipulations, it is unsustainable,” he says.

Present US price lists on Chinese language items range from 100% on electrical automobiles to twenty-five% on metal and aluminium. Till now, a number of top-selling pieces had been exempt, together with electronics, corresponding to TVs and iPhones.

However the 10% blanket tariff Trump is proposing may have an effect on the cost of the entirety this is made in China and exported to america. That applies to a large number of issues – from toys and tea cups to laptops.

Xiqing Wang/ BBC

Xiqing Wang/ BBCMr Huang says this could inspire extra factories to transport somewhere else. A number of new workshops have sprung up round him and Chinese language firms from textile manufacturing heartlands corresponding to Shandong, Zhejiang, Jiangsu and Guangdong are shifting in to make iciness jackets and woollen clothes.

Round 90% of clothes factories in Cambodia are actually Chinese language-run or Chinese language-owned, in step with a document through perception and research staff Analysis and Markets.

Part of the nation’s international funding flows from China. Seventy % of roads and bridges had been constructed the usage of loans Beijing distributed, in step with Chinese language state media.

Most of the indicators on eating places and stores are in Chinese language in addition to Khmer, the native language. There is even a hoop street named Xi Jinping Side road in honour of the Chinese language president.

Cambodia isn’t a lone recipient. China has invested closely in numerous portions of the sector below President Xi’s Belt and Highway Initiative – a business and infrastructure venture that still will increase Beijing’s affect.

That implies China has possible choices.

Chinese language state media claims that greater than part of China’s imports and exports now come from Belt and Highway international locations, maximum of them in South East Asia.

Xiqing Wang/BBC

Xiqing Wang/BBCThis has no longer came about in a single day, says Kenny Yao from AlixPartners, who advises Chinese language companies on take care of price lists.

Throughout Trump’s first time period, many Chinese language companies doubted his tariff danger, he instructed the BBC. Now they ask if he’ll observe the availability chain and slap price lists on different international locations.

Simply in case he does, Mr Yao says, it will be sensible for Chinese language companies to seem additional afield: “As an example, Africa or Latin The usa. This is more challenging, however it’s just right to take a look at spaces you haven’t explored sooner than.”

As The usa pledges to seem after itself first, Beijing is doing its highest to look a strong trade spouse, and there may be some proof it’s operating.

China has edged previous america to transform the existing selection for international locations in South East Asia, in step with a survey through the Iseas Yusof-Ishak assume tank in Singapore.

Despite the fact that manufacturing has moved in a foreign country, cash nonetheless flows to China – 60% of the fabrics being made into garments at Mr Huang’s factories in Phnom Penh come from China.

And exports are thriving, with Beijing making an investment extra closely in high-end production, from sun panels to synthetic intelligence. Final yr’s business surplus with the sector – at the again of a just about 6% year-on-year leap in exports – was once a file $992bn.

Nonetheless, Chinese language companies – in Jiangsu and Phnom Penh – are getting ready themselves for an unsure spell, if no longer a turbulent one.

Mr Peng hopes america and China could have an “amicable and calm” dialogue to stay the price lists “inside an inexpensive vary” and keep away from a business conflict.

“American citizens nonetheless wish to acquire those merchandise,” he stated, sooner than using off to fulfill new shoppers.