BBC

BBCPaintings and Pensions Secretary Liz Kendall is about to unveil main points of the way the federal government plans to chop billions of kilos from the working-age welfare invoice.

The focal point shall be on lowering spending on health-related and incapacity advantages.

That invoice is emerging unexpectedly and plenty of argue it must be curbed for the sake of the United Kingdom’s public budget – in addition to the commercial and particular person advantages of having other folks again into paintings.

However this isn’t the primary executive to hunt financial savings from the welfare price range, and to check out to inspire extra other folks into employment.

And charities are caution concerning the antagonistic have an effect on on susceptible recipients.

There are 3 huge approaches which the federal government is assumed to be inspecting:

- Reducing the extent of get advantages bills

- Tightening the eligibility for advantages

- Making an attempt to get other folks off advantages and into paintings

BBC Examine has tested the previous 15 years of insurance policies on this space to peer what could be efficient – and what dangers being counterproductive.

Reducing bills

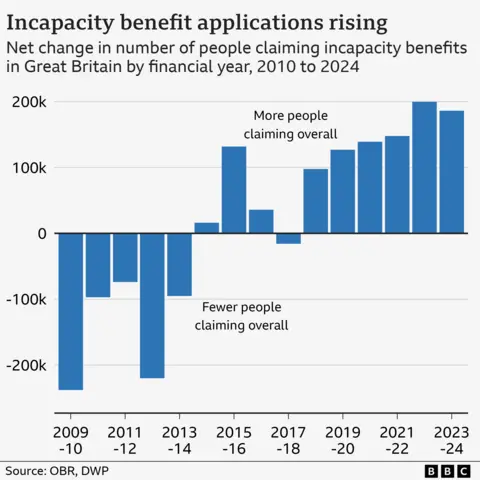

The working-age fitness and incapacity advantages invoice has for sure been expanding in recent times, and is emerging unexpectedly.

The Place of business for Funds Duty (OBR), the professional forecaster, has projected that overall state spending on those advantages for other folks in the United Kingdom elderly between 18 and 64 will building up from £48.5bn in 2023-24 to £75.7bn in 2029-30.

That may constitute an building up from 1.7% of the scale of the United Kingdom financial system to two.2%.

Via 2030, round part of the expenditure is projected to be on disability get advantages, which is designed to offer further source of revenue for other folks whose fitness limits their talent to paintings.

The opposite part is projected to be on Private Independence Bills (PIP), which can be supposed to lend a hand other folks of operating age with disabilities organize the extra daily prices bobbing up from their incapacity.

One easy manner for ministers to curb this projected upward thrust could be to carry bills flat in money phrases, relatively than permitting them to upward thrust in step with costs each and every 12 months.

“Decreasing award quantities is one of the best ways to get financial savings within the quick time period,” says Eduin Latimer of the Institute for Fiscal Research.

Freezing disability advantages in money phrases till 2030 would save £1bn a 12 months, consistent with the Answer Basis.

However you’ll simplest obtain disability get advantages in case your source of revenue and financial savings are underneath a undeniable degree, so freezing bills would have an effect on people who find themselves worse off.

Additionally, other folks on incapacity advantages equivalent to PIP are significantly much more likely to be in poverty and subject matter deprivation.

Underneath earlier governments between 2014 and 2020, maximum working-age advantages didn’t upward thrust in step with inflation – to save cash.

And from 2015, increasingly other folks claimed disability get advantages.

So reducing the worth of particular person bills would possibly avoid wasting cash up entrance, however nonetheless now not have a dramatic have an effect on at the general invoice in the long run if claimants proceed to upward thrust.

Tighten eligibility

Quite than reducing the worth of those advantages for all recipients, the federal government may just search to save cash through making it more difficult for other folks to say them within the first position.

As an example, the former executive had proposed making it more difficult for other folks with psychological fitness stipulations to say PIP, arguing that the per month fee used to be now not proportionate to the extra monetary wishes created through their stipulations.

However it is very important word that efforts to switch the eligibility standards for those advantages over the last 15 years have now not yielded the effects was hoping for.

PIP used to be offered in 2013 to switch the previous Incapacity Residing Allowance, with the purpose it could result in financial savings of £1.4bn a 12 months relative to the former machine through lowering the collection of other folks eligible.

PIP used to be first of all projected to cut back the collection of claimants through 606,000 (28%) in overall.

But the reform ended up saving simplest £100m a 12 months through 2015 and the collection of claimants rose through 100,000 (5%).

Every other strive in 2017 to restrict get admission to to PIP used to be additionally reversed.

The rationale used to be that many of us appealed towards refusals that were brought about through the tightened eligibility standards. Additionally, the emergence of instances within the media which gave the impression unfair supposed ministers, regularly underneath power from their very own backbench MPs, in the long run ordered the eligibility laws to be comfortable.

Reputable choices to not award PIP and disability get advantages to claimants are nonetheless regularly challenged and round a 3rd of the ones demanding situations are in the long run upheld at an unbiased tribunal.

“Britain’s chequered historical past of get advantages reform displays that the federal government must continue cautiously, relatively than rush forward to seek out financial savings which might backfire,” says Louise Murphy of the Answer Basis.

Inspire paintings

Otherwise for the federal government to check out to reach financial savings is through encouraging extra other folks to return off those advantages and input paintings.

Round 93% of disability get advantages claimants aren’t in paintings and the similar is right of 80% of PIP claimants.

One doable path to extend employment charges may well be common reassessments of other folks in receipt of disability get advantages and a demand for them to begin in search of jobs if they’re discovered to be have compatibility for paintings.

The autumn within the collection of other folks claiming disability get advantages within the early 2010s has been attributed through the OBR to reassessments of numerous other folks in receipt of an older type of the ease.

Alternatively, an competitive or exhausting reassessment regime may just possibility enforcing misery on people who find themselves not able to paintings and may just additionally create sudden distortions within the machine.

The OBR has advised the sanctions offered to the broader advantages machine through the closing executive, requiring other folks judged have compatibility to paintings to be actively in search of employment or possibility shedding their advantages, had the counterproductive impact of accelerating the motivation for other folks to check out to say disability advantages (for which those work-searching necessities didn’t follow).

Every other doable coverage road to spice up employment charges is thru offering a lot better make stronger to seek out jobs.

Some suggest expanding executive funding in professional schemes, operating with employers, to lend a hand other folks to go into the place of job.

There were quite a lot of schemes designed to reach this over the last 15 years, even though they’ve now not been on a big scale.

Critiques have proven some certain employment results from them.

Alternatively, the OBR concluded closing 12 months that the proof base used to be nonetheless restricted and didn’t counsel such programmes have, up to now, made a “vital contribution” to getting other folks into paintings.

That suggests the professional forecaster might hesitate to think better state funding in those schemes pays for itself thru upper employment and tax revenues, and lead to internet financial savings in public expenditure.

However, some professionals argue it could make sense for the federal government to re-assess extra incessantly whether or not other folks in receipt of fitness and incapacity advantages are nonetheless not able to paintings and – if their instances are discovered to have modified – to offer them with further make stronger to get into the staff.

“Now not doing reassessments and work-focused interviews for sure makes issues worse,” says Jonathan Portes, a former leader economist on the Division for Paintings & Pensions.

Supply hyperlink

{name}

{content material}