PA Media

PA MediaFor the reason that govt unveiled its new inheritance tax plans for farmers in ultimate month’s Price range, there was intense debate about what number of people shall be affected and to what extent.

Most of the claims from the federal government had been hotly contested by way of farmers, and BBC Test has come below scrutiny over one of the crucial figures it has trusted to check out to determine the collection of farms impacted by way of the exchange.

The talk has revolved round estimates equipped by way of farmers’ teams, together with that the brand new tax may just “hurt” as much as 70,000 farms through the years.

Our research discovered that the determine was once more likely to be someplace nearer to the quantity equipped by way of the federal government – about 500 estates in step with yr. That continues to be our evaluation.

Farmers’ teams say the adjustments had been “constructed on unhealthy information”. The federal government says it needs to make the inheritance tax gadget fairer and discourage rich other folks from making an investment in land only to keep away from the tax.

Right here, we undergo the entire numbers and read about the claims and counter-claims.

What are the contested figures?

Beneath the federal government’s plans, from April 2026, inherited agricultural belongings value greater than £1m, which have been up to now exempt, shall be topic to inheritance tax at 20%.

The Nation Land and Trade Affiliation (CLA) has estimated that the tax exchange “may just hurt” 70,000 UK farms. This might constitute kind of 33% of the 209,000 UK farms, as recognized by way of the Division for Setting, Meals & Rural Affairs (Defra).

The CLA determine isn’t an annual one and, obviously, a farm would simplest be doubtlessly topic to inheritance tax if it was once handed on, following a loss of life.

The federal government, in looking to assess the affect of its tax exchange, seemed as an alternative at contemporary figures for the collection of exact claims for tax aid for agricultural estates.

At this level, it’s value stressing that an agricultural property isn’t the similar as a landed property, or farm: an “property” is a criminal time period for the price of the cash, belongings and possessions a person passes on upon their loss of life. On this case, it’s an property that incorporates some agricultural land.

The Chancellor, Rachel Reeves, has claimed as much as about 520 inherited agricultural estates a yr “shall be impacted to some degree by way of those adjustments”.

The Setting Secretary Steve Reed has stated “3 quarters of farmers pays not anything on account of the adjustments”.

However farming teams proceed to dispute the federal government figures, with the Nationwide Farmers’ Union (NFU) pointing to different figures from Defra which it says “display that simplest 34% of farms are below £1 million internet value”. This might suggest that round two thirds of farms may just doubtlessly be suffering from the Price range tax exchange.

The NFU has additionally launched research which it says presentations that “round 75% of industrial circle of relatives farms shall be above the £1 million threshold”.

Under, we glance into the demanding situations in terms of achieving a precise conclusion at the numbers affected, and supply extra element on which figures are extra dependable – and give an explanation for why.

Is Defra information extra correct?

Farming teams have partly based totally their arguments towards the tax exchange on information from Defra’s Farm Trade Survey, which presentations the web value of farms in England in 2022/23.

The figures recommend that 17% of farms in England have a internet value – the variation between their belongings and liabilities – of between £1m and £1.49m. Every other 49% of farms have a price of £1.5m and over.

This means, at the face of it, that 66% of farms in England may just doubtlessly be suffering from the tax adjustments.

Getty Pictures

Getty PicturesAlternatively there are some issues of this calculation, as the knowledge from the Defra survey isn’t essentially consultant of the total UK-wide farming sector.

The survey – which is according to a pattern of simply over 1,350 farms – states that it’s designed to be consultant of simplest about part of the farms in England (relatively than the remainder of the United Kingdom) and likewise excludes farms which usher in little earnings.

Additionally, the Defra information presentations estimates of person farm values, however does no longer display their possession.

A couple of farms will also be owned by way of a unmarried one who then allows them to out to tenants. In England about 46% of agricultural holdings had been wholly or partly rented out to tenant farmers in 2023 in line with Defra information. If the landlord of more than one farms sought to go on the ones farms upon his or her loss of life, this could all display up in one property within the inheritance tax aid declare.

The monetary affect could be on that specific’s inheritance tax invoice, no longer every farm.

A farm may be collectively owned by way of more than one other folks. If, for instance, 5 other folks owned a £5m farm they might every go on their £1m proportion with out their estates having to pay any inheritance tax.

That is why it’s extra suitable to make use of tax information on inheritance aid, relatively than farm survey information, to estimate the affect of the exchange within the Price range on folks.

Does together with trade belongings aid exchange the image?

Every other problem is that some preliminary govt calculations of the collection of estates more likely to be affected simplest referred to Agricultural Assets Reduction (APR) and no longer Trade Assets Reduction (BPR).

APR relates principally to the price of land. BPR can come with a farm’s equipment and farm animals, which is able to additionally make up an important share of the price of an agricultural property.

It’s true that each APR and BPR aid shall be capped at a blended £1m for inheritance tax functions, which means a unmarried property will be capable of declare not more than £1m in those blended reliefs.

Farming teams have claimed that farmers regularly additionally use BPR so any calculation of the affect of the tax adjustments based totally only on APR claims won’t seize the whole impact on farming estates.

Alternatively, the govt has now printed figures according to HMRC inheritance tax information which incorporate ancient APR and BPR aid claims, and will have to seize the ones agricultural estates applying each reliefs.

Those figures recommend that whilst taking BPR under consideration in addition to APR does push up the quantity and share of estates more likely to be affected, it does no longer basically exchange the image.

The information presentations that during 2021-22 the collection of estates making blended APR and BPR claims the place the price of the property was once greater than £1.5m was once 383, or 22% of all claims.

The collection of estates value greater than £1.5m making APR claims only was once 278, or 16% of the whole.

Why is it £1.5m and no longer £1m?

The federal government’s newest figures damage down the affect the usage of the brink of £1.5m, no longer £1m, explaining to BBC Test that this was once selected according to the idea that a person property’s same old inheritance tax reliefs of £500,000 could be added to their new £1m allowance.

BBC Test requested the Treasury and HMRC for a breakdown of the figures the usage of £1m as a threshold – which might be in line with its unique calculations appearing APR claims simplest – nevertheless it stated it hasn’t collated the ones figures.

The CenTax assume tank has studied the affect of APR and BPR reliefs.

CenTax’s co-director Arun Advani argues that the federal government’s estimates of the collection of agricultural estates more likely to be suffering from the capping of each reliefs at £1m blended – as much as 520 estates a yr – turns out affordable.

“The information on ancient claims are a a lot more dependable information to the collection of affected estates than surveys of farm sizes,” he stated.

“Whilst the federal government’s reforms are for sure more likely to be tough for some farmers, specifically given the various different components weighing down farmer’s earning, numbers claiming tens of hundreds shall be affected don’t seem to be in line with the proof.”

David Sturrock from the impartial Institute for Fiscal Research additionally stated that the Treasury’s figures had been “credible” and added that together with the affect of capping BPR “doesn’t seriously change the image with regards to estates affected”.

The NFU has identified that if 500 estates had been affected in step with yr that would quantity to fifteen,000 over 30 years – however this could nonetheless be a way wanting the 70,000 determine.

Will have to small estates be excluded from calculations?

The NFU argues that many estates integrated within the govt figures are too small to be thought to be running farms.

Its case is understated – in case you had been to exclude those small farms, the share of actual, running farms affected could be a lot upper.

It has pointed to split APR inheritance tax aid claims information from HMRC, by means of the Treasury, which breaks down estates by way of measurement.

This presentations that during 2021-22, 474 claims (27% of the 1,730 general) had been for estates valued between £0 and £250,000, and that 398 (23% of the whole) had been for estates valued at between £250,000 and £500,000.

“Only a few viable farms are value below £1m,” says the NFU president Tom Bradshaw.

Getty Pictures

Getty PicturesThat is a cheap argument.

If estates with a price underneath £500,000 had been excluded from the APR figures, the proportion of the whole affected every yr would routinely upward thrust from the 27% implied by way of the federal government’s preliminary calculations.

The NFU’s research suggests simplest together with what it categorises as “running farms” would build up the proportion affected from 27% to 49%.

Alternatively, the estimated absolute collection of affected estates – kind of 500 in every yr – would no longer be suffering from that adjust.

Is there a £3m allowance?

A key query is the place the efficient monetary inheritance tax threshold for estates with agricultural belongings kicks in.

Farming teams have instructed the price of any inherited property with agricultural belongings over £1m shall be impacted.

That is comprehensible as this was once the brink determine cited within the Price range.

Alternatively, the federal government has since claimed that the efficient threshold for lots of farmers’ estates to pay inheritance tax might be no longer £1m, however £3m, as a result of more than a few inheritance tax reliefs to be had to estates.

The next efficient threshold would have a big affect at the share and collection of estates affected.

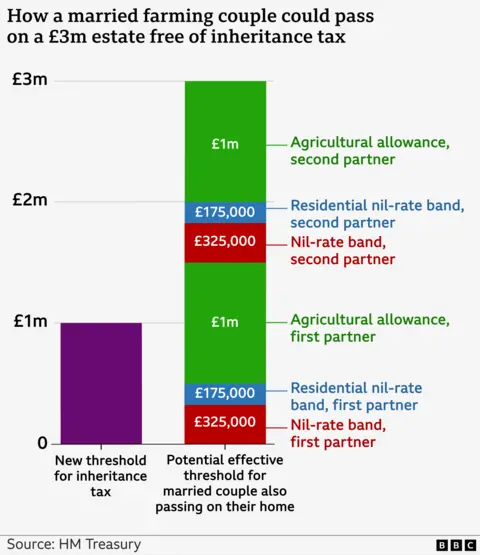

The overnment’s declare is according to the truth that the estates of farmers, just like the estates of everybody else topic to inheritance tax, are eligible for the standard tax-free allowance, referred to as a nil-rate band, of £325,000.

They’re also are eligible for the residential nil-rate band of £175,000. The latter is to be had to people who find themselves passing on a prime place of dwelling to a right away descendant, similar to youngsters or grandchildren, as a part of their property. In combination those two allowances general £500,000.

That is on most sensible of the £1m tax-free allowance for agricultural estates.

It’s no longer simply the £1.5m allowance for a unmarried person – for any person married their partner has a an identical efficient allowance. Including those in combination – and making an allowance for the power of farming {couples} to proportion their allowances – does create a possible for some farming estates to go on £3m totally freed from inheritance tax.

Alternatively, importantly, this would simplest be accomplished if every spouse handed on £1.5m in their general belongings at loss of life sequentially, relatively than in a single £3m property upon the loss of life of the second one spouse.

The power of estates to push up the brink to £3m will even rely on person cases. In fact, no longer each and every farmer is married, and a few will not be passing on a prime place of dwelling.

Alternatively, it’s reputable to suppose that many farming estates would be capable of use those allowances, which can be utilized by the remainder of the inhabitants.

In spite of everything, it’s value noting {that a} farming property will also be suffering from this inheritance tax exchange, with out the property essentially finishing up paying more cash in tax, as a result of the will for people to spend extra time making plans their tax preparations than they did sooner than.