Getty Photographs

Getty PhotographsUS jobs expansion all of a sudden surged final month, suggesting the arena’s biggest’s economic system isn’t about to surrender its declare to be the “envy of the arena” anytime quickly.

Listed below are 3 issues we now have discovered from the most recent numbers.

1. The USA economic system is more potent than anticipated

For years, there were rumblings of outrage a couple of doable downturn on the earth’s biggest economic system.

It has persistently proved the doubters flawed and final month used to be no exception.

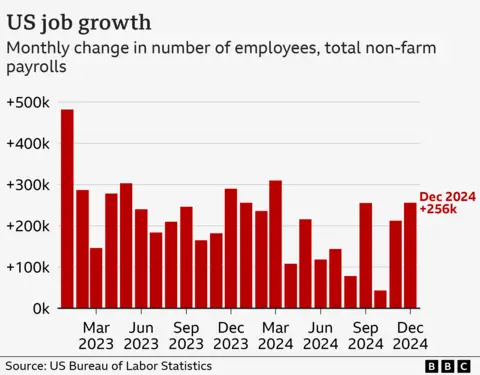

The activity beneficial properties in December had been a lot upper than the more or less 160,000 analysts had anticipated: Employers added 256,000 jobs and the unemployment price dropped from 4.2% in November to 4.1%, the Exertions Division stated.

Total, 2.2 million jobs had been added final 12 months – a median of 186,000 a month.

That marked a slowdown from a 12 months previous, however remains to be a gorgeous wholesome determine.

Reasonable hourly pay used to be up 3.9% final month when compared with December 2023. It is a cast acquire however no longer one so sturdy as to fret analysts that speedy salary expansion will suggested worth will increase to all at once boost up.

Nathaniel Casey, funding strategist at wealth control company Evelyn Companions, referred to as it “the goldilocks of labour marketplace releases”.

2. There might be fewer rate of interest cuts

The USA central financial institution, which is charged with protecting each costs and employment strong, minimize rates of interest for the primary time in additional than 4 years in September, announcing it sought after to go off indicators of weak spot within the jobs marketplace.

It boosted hopes of many would-be debtors in the USA, who’ve been dealing with the perfect borrowing prices in more or less twenty years and had been keen to look them come down.

However the power of this month’s knowledge suggests fears in regards to the jobs marketplace can have been untimely, doing away with drive at the financial institution to behave.

Rates of interest on 10 and 30-year executive debt in the USA jumped after the record, with the latter topping 5%.

Traders had already been paring again bets on cuts this 12 months, anxious by way of indicators that the financial institution’s development on stabilising costs used to be stalling.

There also are dangers insurance policies referred to as for by way of President-elect Donald Trump, similar to sweeping border taxes and migrant deportations, may just elevate costs or wages, hanging drive on inflation.

Although inflation knowledge due subsequent week displays inflation – the speed of worth will increase -cooling, Ellen Zentner, leader financial strategist for Morgan Stanley Wealth Control, stated this jobs knowledge approach she does not be expecting the Fed “to chop charges any time quickly.”

3. Upper US borrowing prices imply upper international charges too

The rates of interest set by way of the USA central financial institution have a formidable affect over borrowing prices for plenty of loans – and no longer handiest in The us.

Borrowing prices globally have larger in contemporary months, responding to expectancies that US rates of interest are prone to stay upper for longer.

In the United Kingdom, for instance, the rate of interest, or yield, on 30-year executive debt hit the perfect degree in additional than 25 years previous this week, hanging drive at the executive because it tries to figure out its spending and borrowing plans.

Whilst the most recent US jobs figures could be excellent information for the USA economic system and its greenback, Seema Shah, leader international strategist at Main Asset Control, warned they’d be “punishing information for international bond markets, specifically UK gilts”, regarding the title of presidency bonds, or debt.

“The height for yields has no longer but been reached, suggesting further stresses that a number of markets, particularly the United Kingdom, can in poor health find the money for,” she stated.