Trade reporter, BBC Information

Getty Pictures

Getty PicturesUK inflation jumped sharply remaining month, pushed by means of emerging meals costs and an build up in non-public faculty charges.

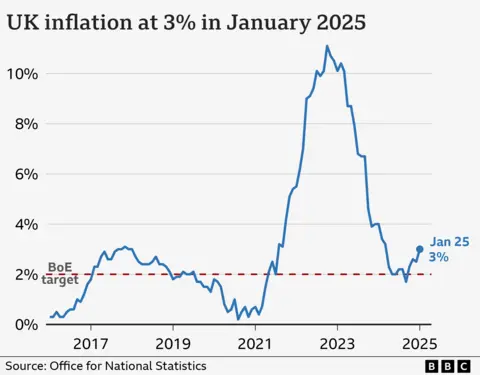

The upper-than-expected leap to a few% within the 12 months to January, from 2.5% in December, manner costs rose on the quickest tempo for 10 months.

Meals staples comparable to meat, bread, eggs and cereals have been all costlier than a 12 months in the past, whilst non-public faculty charges grew by means of about 13% because of VAT being added from 1 January after the federal government got rid of the tax exemption.

Airfares, which didn’t fall up to they in most cases do originally of the 12 months, additionally fuelled inflation which is forecast to upward thrust additional within the coming months, with power costs set to push up the price of dwelling for families.

Emerging meals costs remaining month imply, on moderate, the price of purchasing groceries is 3.3% costlier than it used to be a 12 months in the past.

Many companies have additionally warned that tax rises entering impact in April will lead to costs for patrons going up once more to hide the larger prices.

Sarah Coles, head of private finance at Hargreaves Lansdown, stated the specter of upper salary expenses for supermarkets and meals manufacturers supposed there used to be a “each likelihood” the January spike in meals inflation would now not be the remaining.

There also are long term prices for families at the horizon, with home power costs forecast to upward thrust by means of 5% from April, including £85 a 12 months to to a regular family invoice.

“That is on best of rises in the whole lot from water expenses and council tax – which is why it has change into referred to as Terrible April,” stated Ms Coles.

Inflation is a measure utilized in the United Kingdom to offer a common image of the price of dwelling and is calculated by means of evaluating costs of products and services and products from a 12 months previous.

The VAT fee on non-public colleges got here into impact this January, so the have an effect on on inflation used to be a “one-off”, consistent with Grant Fitzner, leader economist on the Place of job for Nationwide Statistics.

The whole inflation determine in January used to be additionally impacted by means of reductions being “a lot smaller” than customary originally of the 12 months, particularly for airfares, he added.

“We most often see somewhat a big fall in January in costs, there’s a large number of value discounting,” he instructed the BBC’s Lately programme.

Airfares usually cross up as call for for trip spikes round Christmas and New Yr, however the fall again this 12 months has been extra muted, he defined.

Whilst the sharpness of the upward push in inflation got here as a wonder – economists had anticipated a studying of two.8% – it’s a lot less than its height of eleven.1% in October 2022.

That led to raised rates of interest, which has made the price of loans, bank cards and mortgages, costlier.

As inflation has eased, the Financial institution of England has lower rates of interest, together with 1 / 4 level relief to 4.5% this month.

Knowledge on Tuesday estimated moderate wages in the United Kingdom additionally proceed to outpace inflation, with pay packets, after taking into consideration the tempo of value rises, emerging by means of 3.4% between October and December.

However with inflation last above the Financial institution’s 2% goal, January’s determine might be “uncomfortable” for policymakers, consistent with Ruth Gregory, deputy leader UK economist at Capital Economics.

She stated the bounce used to be “no wonder, however it used to be higher than everybody anticipated”, including that she doubted it might save you additional passion cuts this 12 months.

“The danger is that the upward push in inflation proves extra power and charges are lower extra slowly than we predict, or now not as some distance,” Ms Gregory added.

In accordance with the newest figures, Chancellor Rachel Reeves reiterated that her “primary venture” used to be to get “extra kilos in wallet”.

However James Murray, exchequer secretary to the Treasury warned getting inflation go into reverse to the two% goal could be “bumpy”.

“The Financial institution of England has been transparent that they anticipated inflation to be quite upper within the first part of this 12 months….however we are assured in our plan for alternate to be sure that we are kick-starting financial expansion by means of making the reforms which can be vital to spice up financial expansion proper around the nation,” he added.

Each the Conservatives and Liberal Democrats blamed Reeves’s Funds choices for the upward push in inflation.

{identify}

{content material}