BBC

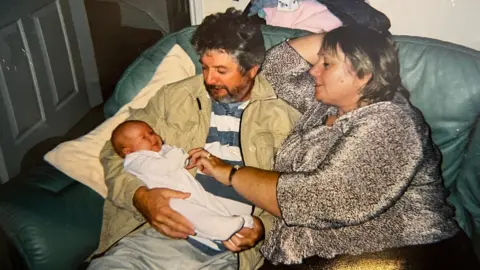

BBCLatonya Skye-Paterson had no concept a Kid Agree with Fund have been arrange for her till her school tutor recommended she take a look at on-line.

“I discovered I had £955 in there, which is so much. Much more than I used to be anticipating… it helped me such a lot,” she mentioned.

New figures recommend £1.4 billion belonging to 728,000 folks is able to be claimed now they have got became 18 – however many have no idea the accounts exist, in step with a charity that strains misplaced finances.

Now a senior MP is backing requires pay-outs to be made robotically for a few of these accounts – a plan the federal government says can be advanced and expensive.

Latonya, 20, is certainly one of 6.3m folks born between Sept 2002 and Jan 2011 who had a kid consider fund kick began by means of a fee, typically £250, from the federal government.

The speculation was once the long-term tax-free financial savings pot would pass up in price by means of their 18th birthdays.

The common quantity in Kid Agree with Budget is estimated to be round £2,000 as a result of enlargement over time and more cash installed by means of friends and family.

However like masses of hundreds of others, when Latonya became 18 she had no concept her fund existed.

The Proportion Basis, a charity which is helping folks monitor down misplaced and unclaimed finances, is looking for computerized pay-outs for a few of these finances if they have no longer been claimed by the point account holders flip 21.

“I feel it is a nice plan to be truthful,” mentioned Latonya. “My school tutor advised me about it however my brother is a yr older and went to the similar school and he wasn’t advised about it so it is good fortune of the draw who is aware of, who tells who.

“Particularly with value of dwelling, getting it robotically whilst you did not know you had it would in reality give folks a destroy that they want.”

This “default withdrawal at 21” plan covers accounts the place no motion was once taken by means of oldsters or carers to arrange a consider fund after being despatched the preliminary voucher from executive.

Those “misplaced” finances are known as “HMRC allotted accounts” and quantity 449,000 accounts conserving £927m.

It’s those finances which campaigners are calling to be robotically paid to account holders the use of Nationwide Insurance coverage numbers if they are no longer claimed by the point folks flip 21 years outdated.

The Nationwide Insurance coverage numbers might be used to track account holders by way of PAYE payslips, scholar loans or advantages.

‘Treasure trove’

Sir Geoffrey Clifton-Brown is an MP who additionally chairs Parliament’s Public Accounts Committee.

Talking in his function as an MP he advised Radio 4’s Cash Field he backs the automated pay-out concept.

“I liken this cash somewhat to a treasure trove buried on a [desert] island in huge acres of sand anticipating the deficient recipients on those kid consider finances to head and in finding this cash,” he mentioned.

“I feel there may be much more shall we do to inspire the federal government to seek out the recipients.”

Sir Geoffrey mentioned he’d be urgent the Treasury and HMRC subsequent time they seem in entrance of the Public Accounts Committee in this factor.

UK Parliament

UK ParliamentHMRC mentioned it was once thankful for the advice of the “default withdrawal at 21” plan from The Proportion Basis however mentioned the proposal was once advanced and may just no longer be applied simply.

“For HMRC to near those accounts, download the financial savings in the ones accounts and switch them without or with the landlord’s consent will require cautious criminal attention,” a spokesperson mentioned.

They added the transfer would additionally require “operational methods and sources” throughout executive departments and Kid Agree with Fund suppliers to observe the transactions.

“The federal government is dedicated to reuniting all younger adults with their CTFs and recognises the significance of making sure that younger adults can have the benefit of those finances as they succeed in maturity.”