Getty Pictures

Getty PicturesIt has no longer been a just right week for Chancellor Rachel Reeves.

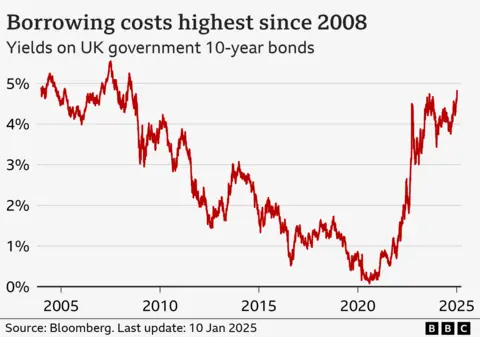

Executive borrowing prices have hit their best possible stage in 16 years and the pound has fallen to a 14-month low in opposition to the greenback.

She has long past on a deliberate shuttle to China amid accusations from opposition events that she is leaving at a second of monetary peril.

Financial institution of England governor Andrew Bailey is accompanying her at the shuttle. The 12-hour flight to Beijing is most likely the duration of the assembly she would possibly have sought after to have with him.

So how severe are the new actions at the markets and what may occur consequently?

Finances plans want to be tweaked

Whilst the markets stabilised from Thursday lunchtime, the transfer in opposition to UK govt debt is already sufficient to reason an issue for the chancellor’s Finances maths.

Reeves has pledged to not borrow to fund day by day spending and to get debt falling as a percentage of nationwide source of revenue by way of the top of this parliament. The Treasury has mentioned those fiscal laws, set out within the Finances, are “non-negotiable”.

Every now and then during the last week the markets have appeared lovely fragile for Britain, with each govt borrowing prices going up and sterling falling again on the identical time. That may be a key marker.

Whilst it is true that the entire course for the markets during the last month has been set by way of an evaluate of the inflationary penalties of President-elect Trump’s commerce and financial insurance policies, the United Kingdom has been getting some particular consideration as well as.

It dangers being tarred with each the inflationary stickiness of the USA, and the stagnant enlargement of the eurozone – the worst of each worlds.

That mentioned, it is very important be actual in regards to the extent of the issue. The additional value of servicing the nationwide debt at those rates of interest could be a number of billion kilos a yr – i.e. subject matter sufficient to require some type of correction within the Finances maths, however possible, and the transparent message this week is that “it’ll be achieved”.

No have an effect on on mortgages thus far

The have an effect on on budgetary maths is actual, however the wider have an effect on that could be anticipated – of upper borrowing prices for firms and for families – has no longer but materialised.

The loan marketplace has but to peer an building up in charges for fixed-term mortgages, as passed off abruptly within the panic after the 2022 mini-Finances. There’s a curious calm.

One rationalization lies in what isn’t going down. This time remaining yr the key lenders a great deal discounted mortgages in a struggle for marketplace percentage forward of the important thing moments for space purchasing. This has no longer came about this yr, and might but have a outcome within the belongings marketplace.

The Financial institution of England has indicated it’ll proceed with rate of interest cuts this yr. The markets assume there could also be some distance fewer than up to now anticipated, possibly just one, leaving base rates of interest at 4.5%.

Many economists say that is the improper name, and consider charges shall be lower a couple of instances. There may be slightly a large number of uncertainty right here, and the important thing Financial institution of England committee is divided. The Financial institution’s phrases shall be very in moderation watched.

Extra undoubtedly for the economic system, regardless of a large number of rhetoric from outlets, many have delivered sturdy effects and feature no longer diminished their income expectancies. Are customers a bit of extra tough than were assumed, and may this pressure some enlargement in 2025?

Enlargement technique wishes a reboot

The issue of servicing upper pastime bills at the nationwide debt will increase the possibility of the Treasury planning for an adjustment, according to a squeeze on spending. A £10bn lower will harm, however with a majority of 170 MPs within the Area of Commons, and an ongoing spending evaluate already in teach, it may be achieved.

In those instances, with the credible danger of an international commerce warfare, as an example, it must be famous that Rachel Reeves’ new fiscal laws do have an get away hatch.

Within the tournament of “an emergency of a vital adverse financial surprise to the economic system” the chancellor might “briefly droop the fiscal mandate”.

Whilst an international commerce warfare may qualify, it will be tricky optics to droop a “non-negotiable” and “iron-clad” algorithm earlier than that they had actually bitten. The principles have no longer but officially handed into legislation but both, and stay a “draft” till the Commons votes to approve them.

It sort of feels most unlikely that this path shall be taken until there’s a very transparent financial surprise within the coming weeks.

The larger level here’s what issues within the markets, which is whether or not the United Kingdom is pursuing a reputable set of insurance policies, a powerful general technique.

Labour’s center of attention on steadiness in any respect prices was once comprehensible after the humiliation of Liz Truss’s mini-Finances. However “steadiness” isn’t a enlargement technique.

Pursuing inexperienced enlargement by way of borrowing for long-term capital funding is a possible technique, and it underpinned “Bidenomics” in the USA. The incoming govt embraced the rhetoric of US coverage beneath the outgoing president, with out the similar firepower. “Bidenomics with out the cash”, chances are you’ll say.

However now the brand new Trump management is jettisoning this method, rightly or wrongly, and the markets are much less satisfied that the sort of technique pays for itself. It is going to value extra to fund the sort of technique, and require harsher trade-offs than anticipated.

Bidenomics with out each the cash and with out Biden is far too skinny. A extra detailed technique for sustained enlargement is wanted, and briefly order.