Getty Photographs

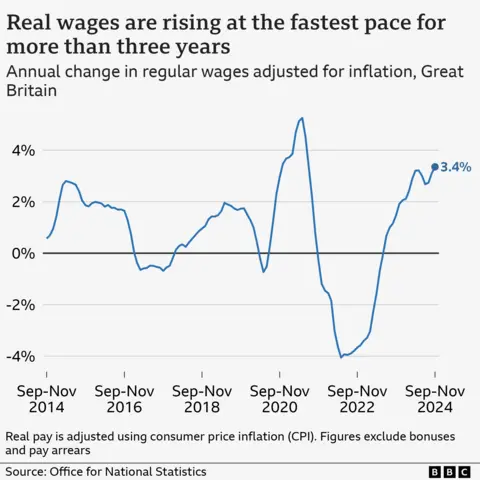

Getty PhotographsUK pay after inflation has risen at its quickest price for greater than 3 years, pushed by way of sturdy salary enlargement within the non-public sector.

Pay packets higher on reasonable by way of 3.4% between September and November when compared with the similar duration a yr in the past after bearing in mind the affect of worth rises, in step with the Place of job for Nationwide Statistics (ONS).

Expansion in non-public sector income was once more potent than for public sector jobs.

Regardless of a possibility of upper wages pushing up inflation, the Financial institution of England continues to be anticipated to chop rates of interest subsequent month.

Charges are recently at 4.75%, however investors have wager on a minimize to 4.5% in February, after inflation, which measures the speed costs upward push at through the years, rapidly fell closing month.

The Financial institution of England watches the pay and jobs knowledge intently when making choices on rates of interest. The newest ONS figures estimated that reasonable weekly income in the United Kingdom hit £660 in November, when inflation was once 2.6% – the newest determine is two.5%.

“Pay hasn’t put this a lot transparent blue water between itself and inflation for round 3 and a part years, so the variation is palpable. It is leaving us with extra money on the finish of the month,” mentioned Sarah Coles, head of private finance at Hargreaves Lansdown.

Ms Coles warned there was once a possibility emerging wages may result in upper inflation and rate of interest cuts being behind schedule, however added “on steadiness, the loss of enlargement within the financial system, and a month of falling inflation, are more likely to imply a price minimize in February continues to be at the playing cards”.

Ashley Webb, UK economist at Capital Economics, added one of the Financial institution’s policymakers “could also be apprehensive” by way of the resurgence in non-public sector pay enlargement, however mentioned she suspected maximum of them can be “take a look at the indicators that the loosening within the labour marketplace”, and minimize charges.

The United Kingdom’s unemployment price was once estimated to have ticked as much as 4.4%, whilst the estimated choice of vacancies dropped 2.9% to 812,000 from October to December, proceeding the decline however nonetheless ultimate above pre-Covid pandemic ranges.

The ONS urged treating its jobs marketplace figures with “warning”, because of questions over the relatability of the information led to by way of low reaction charges to its survey.

Petra Tagg, director at recruitment company Manpower UK, informed the BBC’s These days programme that organisations were “providing top charges of pay” as they regarded for staff with explicit abilities for jobs in engineering, IT, and synthetic intelligence.

However she mentioned staff have been “much less more likely to be transferring [companies] as individuals are extra apprehensive to search for employment in those… relatively relating to occasions”.

Economics at Pantheon Macroeconomics mentioned employment dropped in December as “companies put hiring on dangle” following tax rises introduced on companies within the Funds.

Chancellor Rachel Reeves, who has been below power following figures appearing the United Kingdom financial system has flatlined, made up our minds that companies will have to naked the brunt of £40bn value of tax rises, with hikes within the Nationwide Insurance coverage price and a discount to the edge for employers.

Companies have again and again warned the additional prices, in conjunction with minimal wages emerging and industry charges aid being lowered, may affect the financial system’s talent to develop, with employers anticipating to have much less money to provide pay rises and create new jobs.

However Rob Wooden, leader UK economist at Pantheon, added: “There’s little signal from jobless claims and redundancies of a pointy labour marketplace downturn. The labour marketplace is loosening, however most effective steadily.”

Ms Coles mentioned the “just right information on wages” might be short-lived going additional into the yr as there was once a “possibility” that companies going through upper prices “will reduce on each team of workers and salary rises”.

The United Kingdom has had employee shortages for more than a few sectors in recent times. It will drag on financial enlargement, however too can result in staff in the ones industries securing upper pay offers as employers search to draw them or present bosses attempt to retain them.

However inflation can apply when client spending will increase because of folks having extra disposable source of revenue, pushing up call for for items and resulting in costs within the stores emerging.

Common pay higher by way of an annual reasonable of five.6% between September and November, when compared with the similar duration the yr earlier than, but if bearing in mind inflation, the actual salary building up was once 3.4%.

Paintings and Pensions Secretary Liz Kendall mentioned the roles marketplace and salary figures have been “extra proof” that the United Kingdom had to spice up employment.

She added the federal government was once “operating to spice up residing requirements and get the financial system rising”, however reforming Jobcentres and “making certain each and every younger individual has the danger to be incomes or studying”.