Getty Photographs

Getty PhotographsThe pound has dropped to its lowest worth towards the greenback since November 2023 whilst govt borrowing prices have persevered to upward thrust.

The pound fell to $1.21 on Monday morning as the new sell-off persevered.

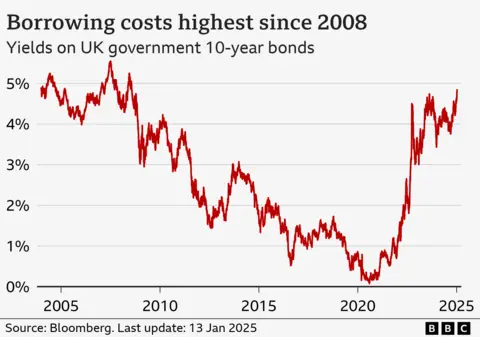

In the meantime, the velocity at which the federal government can borrow cash – referred to as the yield – rose once more, hitting its best possible stage since 2008 by way of one measure.

Borrowing prices for lots of nations are emerging the world over, regardless that some have mentioned selections made within the Funds have made the United Kingdom in particular susceptible.

Governments in most cases borrow cash by way of promoting bonds to important buyers, reminiscent of pension budget. UK govt bonds are referred to as gilts.

The yield at the 10-year gilt – the rate of interest at which the federal government will pay again a decade-long mortgage to buyers – has risen to 4.86%, its best possible stage in just about twenty years.

The 30-year gilt rose to five.42%, its best possible stage in 27 years.

Executive debt prices in Germany, France, Spain and Italy have additionally all risen as markets opened on Monday morning.

Some mavens say buyers are reacting to the re-election of former US President Donald Trump and his communicate of price lists.

There may be fear this may occasionally result in inflation being extra continual than prior to now idea, and due to this fact rates of interest won’t come down as temporarily as anticipated, each in america and somewhere else.

Robust US jobs knowledge launched on Friday additionally added to expectancies that US charges will keep upper for longer, and this has helped to reinforce the worth of the greenback towards different currencies.

On the other hand, Emma Wall, head of platform buyers at Hargreaves Lansdown, mentioned the United Kingdom’s issues weren’t purely brought about by way of world problems, arguing that measures introduced within the Funds have stoked inflation.

“If you’ll get inflation underneath keep an eye on, you’re going to see rates of interest come down in the United Kingdom,” she added.

Self assurance ‘bruised’

The federal government has made rising the United Kingdom’s economic system a key goal, however contemporary figures point out the economic system noticed 0 enlargement between July and September, whilst it gotten smaller right through October.

Companies have warned that Funds measures, reminiscent of the upward thrust in employer Nationwide Insurance coverage contributions, at the side of the upper Nationwide Residing Salary may just result in process cuts and value rises.

Rupert Soames, chair of the Confederation of British Trade (CBI), mentioned the image was once “now not just right” however insisted that corporations and buyers had been nonetheless moderately upbeat.

“I would not say self belief is long gone,” he advised the BBC’s These days programme. “I would say it is bruised.”

On the other hand, he mentioned the federal government was once making the location worse by way of introducing the Employment Rights Invoice, which he mentioned contained “robust dissuaders to employment”.

Unions argue the protections offered within the invoice, reminiscent of banning fireplace and rehire, make staff more secure, however Mr Soames mentioned it might result in process losses.

“Companies won’t handiest now not make use of, they’re going to let folks move,” he mentioned.