Value of residing correspondent

Getty Pictures

Getty PicturesTwo main lenders introduced loan offers on Thursday with rates of interest of lower than 4%, as festival selections up within the sector.

The possibility of additional cuts within the base charge through the Financial institution of England has given loan suppliers self assurance to cut back their very own charges.

However the eye-catching sub-4% offers through Santander and Barclays may not be to be had to all debtors, specifically first-time patrons, and would possibly include a hefty price.

The go back of such offers would possibly steered different lenders to observe go well with after a length of tepid festival.

National, the United Kingdom’s largest development society, has stated it’ll cut back a few of its charges on Friday.

Loan offers with rates of interest beneath 4% have no longer been observed since November.

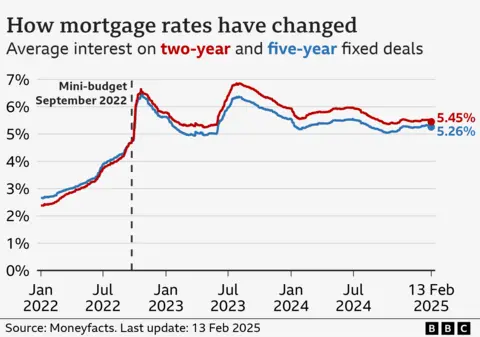

Throughout the entire marketplace the typical charge on a two-year constant deal is 5.48%. The standard charge on five-year offers is 5.29%, in keeping with newest figures from Moneyfacts.

“Debtors had been crying out for higher loan charges and we’re beginning to see them,” stated Aaron Strutt, of dealer Trinity Monetary.

“In case your loan is arising for renewal quickly and you have got already decided on a brand new deal, this is a just right time to check it and doubtlessly switch to a greater charge.”

Time to come to a decision

Some tracker and variable charge mortgages transfer relatively carefully consistent with the Financial institution’s base charge, which was once lower to 4.5% per week in the past. Alternatively, greater than 8 in 10 loan consumers have fixed-rate offers.

The rate of interest on this type of loan does no longer alternate till the deal expires, most often after two or 5 years, and a brand new one is selected to exchange it.

About 800,000 fixed-rate mortgages, these days with an rate of interest of three% or beneath, are anticipated to run out once a year, on reasonable, till the tip of 2027.

That implies a better per month invoice for many householders on their subsequent renewal, however there are indicators that the velocity they may pay is on its method down.

Financial institution of England governor Andrew Bailey stated the interest-rate environment committee anticipated so that you can lower charges additional “however we can have to pass judgement on assembly through assembly, how some distance and how briskly”.

This may occasionally have an effect on savers who’re seeing decrease returns, however may just convey higher information for debtors. The Financial institution’s subsequent charges choice is on 20 March.

The markets and lenders expect extra base charge cuts this 12 months, observed thru so-called switch charges. So, charges for brand spanking new constant loan offers are predicted to fall – particularly as loan suppliers generally tend to transport as a pack.

“It was once just a subject of time for lenders to convey again sub-4% mortgages,” stated Rachel Springall, from monetary knowledge provider Moneyfacts.

“This can be a sure injection to the loan marketplace and when a large lender makes any such transfer, it may steered its friends to observe go well with with cuts of their very own.

“The hundreds of thousands of loan debtors having a look to refinance this 12 months want some just right information.”

Learn the details

Eligible debtors for the sub-4% charges will want a 40% deposit, which is able to close off those offers to many debtors, particularly some first-time patrons.

They may additionally have a somewhat huge price, so debtors will wish to test whether or not the whole worth works for them.

Extra call for for properties from patrons may well be generated if loan charges fall for a chronic length.

In its newest survey, the Royal Establishment of Chartered Surveyors (RICS) stated that housing marketplace task was once anticipated to select up over the approaching months following a flat begin to the 12 months.

Separate figures display landlords had been feeling the force from somewhat top loan charges.

Repossessions of houses from landlords in England and Wales hit some other report top remaining 12 months, in keeping with the Ministry of Justice.

Each repossession claims – the beginning of the method – and precise repossessions rose within the ultimate quarter of the 12 months, with instances concentrated in London.

That, in flip, may just create issues for availability for tenants if those properties are misplaced to the condo sector.

Techniques to make your loan extra reasonably priced

- Make overpayments. Should you nonetheless have a while on a low fixed-rate deal, you may be able to pay extra now to save lots of later.

- Transfer to an interest-only loan. It may stay your per month bills reasonably priced even though you will not be paying off the debt accumulated when buying your home.

- Lengthen the lifetime of your loan. The standard loan time period is 25 years, however 30 or even 40-year phrases at the moment are to be had.