BBC Trade

Getty Photographs

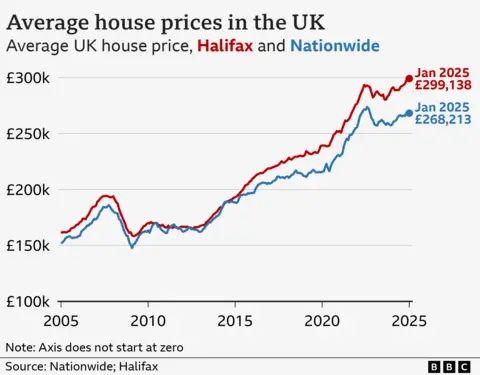

Getty PhotographsUK space costs have hit every other document prime with the common belongings worth attaining £299,138, Halifax has mentioned.

The United Kingdom’s biggest loan lender, a part of Lloyds Banking Staff, mentioned belongings values recovered in January after seeing a slight dip in December.

The yearly enlargement in costs slowed to a few.0%, which is the weakest charge since July 2023, however Halifax mentioned the marketplace used to be appearing “noteworthy” resilience.

Amanda Bryden, head of mortgages at Halifax, mentioned there used to be “sturdy call for for brand new mortgages and enlargement in lending”, which may well be being pushed by means of first-time patrons seeking to whole offers earlier than an building up in stamp accountability in April.

Within the Finances in October closing 12 months, Chancellor Rachel Reeves mentioned that diminished stamp accountability charges in England and Northern Eire would lead to April subsequent 12 months.

The adjustments will imply that space patrons will get started paying stamp accountability on houses over £125,000, as an alternative of over £250,000 at the present time.

First-time patrons lately pay no stamp accountability on properties as much as £425,000, however this will likely drop to £300,000 in April.

“As issues stand, loan charges are more likely to hover between 4% and 5% in 2025, influenced by means of each world monetary markets and home financial coverage,” Ms Bryden mentioned.

Jonathan Hopper, leader government of Garrington Belongings Finders, mentioned the minimize in rates of interest on Thursday would assist house patrons and other people remortgaging.

“At the moment worth inflation is centred on northern England and Wales.”

“Somewhere else, the cost rises are a lot more modest and dealers wish to worth their properties in moderation or possibility seeing them caught unsold at the shelf.”

The place are costs emerging the quickest?

London stays the costliest position in the United Kingdom to shop for a space, with the common belongings there costing £548,288, up 2.8% from a 12 months previous.

Houses in Northern Eire noticed the most powerful annual worth upward push of five.9%, with a median belongings now at £205,473.

Space costs in Wales rose 3.6% in comparison to closing 12 months, with belongings values averaging £227,397.

In England, the North East changed the North West because the area with the most powerful annual worth enlargement, with values expanding by means of 5.2% to £178,696.

Scotland noticed a decrease upward push in space costs total, up 2.4%, with houses now costing a median of £210,690.

“At the moment worth inflation is centred on northern England and Wales.”

“Somewhere else, the cost rises are a lot more modest and dealers wish to worth their properties in moderation or possibility seeing them caught unsold at the shelf,” mentioned Jonathan Hopper, leader government of Garrington Belongings Finders.

Halifax’s space worth knowledge is primarily based by itself loan lending, which doesn’t come with patrons who acquire properties with money, or buy-to-let offers. Money patrons account for approximately a 3rd of housing gross sales.