Getty Pictures

Getty PicturesUpcoming adjustments to stamp accountability will “encourage” first-time consumers to shop for a belongings, in step with the Halifax.

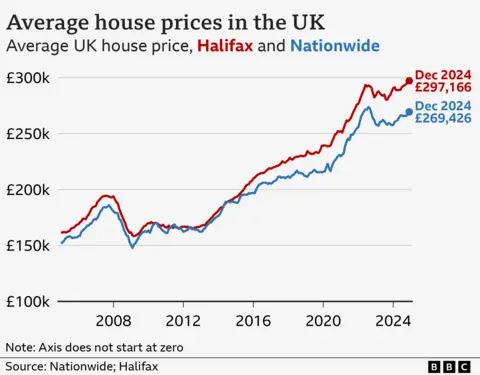

The common value of a UK domestic ended 2024 as regards to the £300,000 mark, the United Kingdom’s greatest loan dealer stated.

Its calculations recommended UK space costs larger via 3.3% when evaluating the tip of the yr to the beginning, despite the fact that the typical worth dipped reasonably in December.

It way the typical domestic now prices £297,166, it added.

In April, space consumers in England and Northern Eire will get started paying stamp accountability on houses over £125,000, as an alternative of over £250,000 at the present time.

First-time consumers recently pay no stamp accountability on properties as much as £425,000, however this may occasionally drop to £300,000.

Affordability stays ‘a problem’

The Halifax’s figures come a couple of days after rival lender, the National, stated that the United Kingdom housing marketplace have been “remarkably resilient” in 2024, with a 4.7% building up in costs on the finish of the yr when put next with the beginning.

The 2 lenders use their very own loan information, and feature reasonably differing standards when calculating space costs, so the National places the typical belongings value at virtually £270,000.

Each lenders don’t come with consumers who acquire properties with money, or buy-to-let offers, of their estimates. Money consumers account for approximately a 3rd of housing gross sales.

The Halifax estimate of the typical domestic now costing as regards to £300,000 can be met with dismay via many first-time consumers, however comes within the context of sharp variations in costs in numerous portions of the rustic.

On the other hand, Amanda Bryden, head of mortgages on the Halifax, stated stamp accountability adjustments in April would give potential first-time consumers “even better motivation to get at the housing ladder and produce any home-buying plans ahead”.

“Loan affordability will stay a problem for lots of,” she stated.

“On the other hand, offering employment stipulations do not become worse markedly from a newer softening, purchaser call for will have to hang up somewhat smartly and, taking all this under consideration, we are proceeding to look forward to modest space value expansion this yr.”

Loan agents have informed the BBC they’re on tight cut-off dates, as many consumers could also be driven to finish prior to April.

Any person beginning a seek for a belongings now would most likely combat to transport prior to the stamp accountability adjustments.

Stamp accountability will impact marketplace

Housing professionals be expecting gross sales to extend over the following couple of months, forward of the stamp accountability adjustments, prior to falling away afterwards.

Alice Haine, analyst at Bestinvest, stated: “This may increasingly ship a in particular heavy hit to first-time consumers who won’t solely want to elevate sufficient cash for a deposit but additionally sufficient to hide the upper tax invoice.”

There could also be an expectation of a gradual aid in rates of interest all through 2025, probably beginning with a minimize in February, which might imply lenders chopping the price of new constant loan offers in anticipation.

On the other hand, Financial institution of England governor Andrew Bailey not too long ago stated “the arena is just too unsure” to make correct predictions of when rates of interest will fall, and via how a lot.

Techniques to make your loan extra reasonably priced

- Make overpayments. When you nonetheless have a while on a low fixed-rate deal, you could possibly pay extra now to save lots of later.

- Transfer to an interest-only loan. It might stay your per thirty days bills reasonably priced despite the fact that you will not be paying off the debt amassed when buying your own home.

- Lengthen the lifetime of your loan. The standard loan time period is 25 years, however 30 or even 40-year phrases at the moment are to be had.